Employer of Record (EOR) service providers in Kazakhstan: 10 best to consider in 2026

- Oct 24, 2025

- 13 min read

Table of contents:

Introduction: Employer of Record (EOR) service providers in Kazakhstan

Why are Employer of Record (EOR) services in demand in Kazakhstan

What makes the best Employer of Record (EOR) providers in Kazakhstan

Top 10 Employer of Record (EOR) service providers in Kazakhstan (2026 comparison)

Comparison table: Top 10 Employer of Record (EOR) companies in Kazakhstan (2026 overview)

Comparing Employer of Record (EOR) pricing models in Kazakhstan: Flat vs. percentage-based

How to choose the best Employer of Record (EOR) in Kazakhstan

Local vs. global EOR providers in Kazakhstan: Which is right for you?

Introduction: Employer of Record (EOR) service providers in Kazakhstan

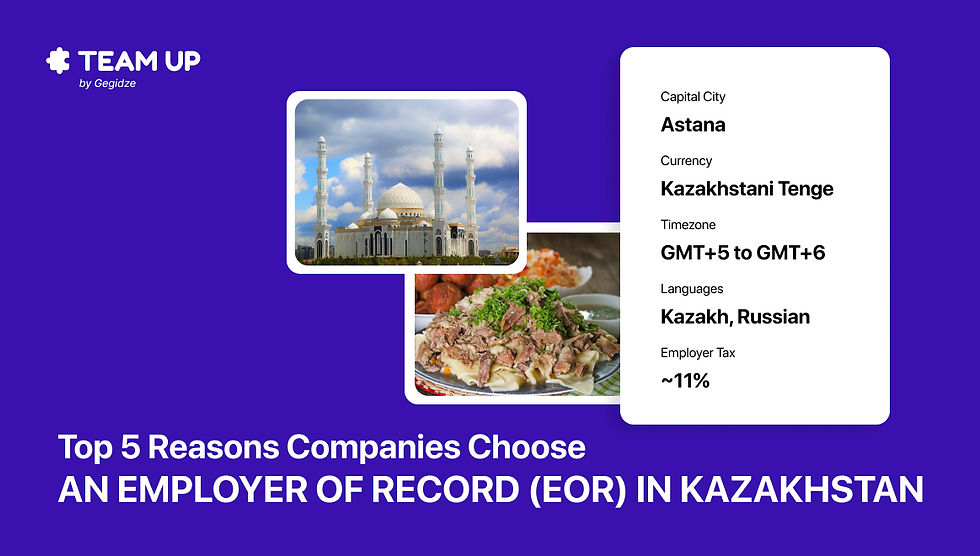

Kazakhstan is fast becoming Central Asia’s talent magnet, a bridge between Europe, China, and the Middle East with a workforce that’s multilingual, affordable, and highly skilled. But hiring here comes with its fair share of legal puzzles.

If you’re thinking about building a team in Almaty or Astana, you’ll quickly learn this: payroll, taxes, and compliance aren’t DIY projects.

That’s why Employer of Record (EOR) service providers in Kazakhstan are catching the attention of startups, global enterprises, and investors.

They help you hire local employees without setting up a legal entity, taking care of payroll taxes, contracts, and compliance filings under Kazakh labor law.

According to PwC Kazakhstan’s 2025 tax guide, local employers must withhold 10% income tax, make 9.5% pension contributions, and file reports to the State Revenue Committee, all in strict accordance with local deadlines. A single missed filing can lead to audits or financial penalties.

So, who should you trust to get it right?

Here’s a complete breakdown of the 10 best Employer of Record (EOR) companies in Kazakhstan for 2026, what makes them different, and why TeamUp is leading the pack across Central Asia, MENA, and the Caucasus.

Why are Employer of Record (EOR) services in demand in Kazakhstan

Kazakhstan isn’t new to business. It’s one of the world’s top resource economies, a key player in energy and logistics, and a rising center for IT and fintech talent. But the rules of employment are layered and strictly enforced, which makes hiring through an EOR the smart play.

Here’s the reality:

All employees must be registered with Kazakhstan’s Unified Accumulative Pension Fund (UAPF).

Employers must contribute to social insurance and medical insurance funds.

Payroll taxes must be filed electronically with the State Revenue Committee every month.

Labor contracts must follow the Kazakhstan Labor Code and be issued in Kazakh or Russian.

For foreign companies, this is a compliance minefield.

That’s why the demand for Employer of Record services in Kazakhstan has skyrocketed — allowing global employers to build teams here without setting up an expensive local subsidiary.

EORs take full responsibility for your local workforce: contracts, payroll, benefits, and compliance filings. You manage your people, they handle the paperwork.

What makes the best Employer of Record (EOR) providers in Kazakhstan

Choosing the right EOR in Kazakhstan is about more than just pricing. It’s about who actually knows the local system, who’s filing directly with authorities, issuing bilingual contracts, and keeping your company audit-proof.

Here’s what separates the best from the rest:

1. Real in-country operations (not outsourced partners)

Most global EOR platforms don’t actually operate in Kazakhstan. They subcontract payroll and compliance to local law firms, which means delays, lost communication, and zero accountability when things go wrong.

The best providers, like Team Up, work directly with Kazakh authorities through their own local entities. They file payroll taxes, pension contributions, and insurance reports internally, without passing your data around to third parties.

That’s how you stay compliant and protected.

2. Transparent, predictable pricing

You can’t scale in a market like Kazakhstan if your costs fluctuate with every new hire.

Most global EORs charge 10–15% of employee salary, which means your employer of record cost in Kazakhstan balloons as your team grows.

Team Up uses a flat-rate model, €199 per employee/month, that covers payroll, compliance, contracts, and HR support. One number, every month, no surprises.

If you’re managing budgets across multiple countries, that kind of stability is gold.

3. Payroll that actually works in Kazakhstan

Kazakh payroll isn’t as straightforward as it looks. You’re dealing with:

10% personal income tax (PIT) withheld by employers.

3.5% social tax and 2% mandatory medical insurance.

5% mandatory pension contributions to the UAPF.

Electronic filings submitted in Kazakh or Russian.

A good EOR doesn’t just pay your people, it registers them correctly, remits taxes on time, and produces compliant payslips in both Kazakh and English.

According to EY’s Global Payroll Insights 2025, companies using localized EORs reduce payroll compliance errors by 40% compared to outsourced solutions.

4. Bilingual contracts and HR support

Under Kazakh law, all employment agreements must be written in Kazakh or Russian.

If your EOR only issues English contracts, you’re exposed.

The top EOR providers offer bilingual documentation and on-the-ground HR support so you can manage employees clearly, in English for your team, in Kazakh or Russian for the authorities.

It’s not just a formality. It’s compliance.

5. Regional scalability

Kazakhstan is your entry point into Central Asia — but it’s rarely the final stop.

If you’re planning to expand into Uzbekistan, Georgia, or Azerbaijan, you’ll want an EOR that operates regionally.

Team Up handles cross-border payroll and compliance across Central Asia, the Caucasus, MENA, and Eastern Europe, under one platform and one invoice. That means no juggling multiple vendors, systems, or contracts.

6. Speed and local accountability

A strong EOR can onboard a new employee in 3–5 business days, from contract to first paycheck.

If it takes longer, it’s a sign they’re outsourcing.

The best providers give you direct communication with local HR managers, real people in Almaty or Astana, not chatbots or “ticket systems.”

In short, the best Employer of Record (EOR) service providers in Kazakhstan combine local legal precision, bilingual expertise, and regional scalability, everything global employers need to hire fast and stay compliant.

Top 10 Employer of Record (EOR) service providers in Kazakhstan (2026 comparison)

Let’s get to what you came here for: the companies actually doing this right.

1. Team Up: Best local and regional EOR provider in Kazakhstan

Team Up leads the market for one simple reason: they operate like a true local partner.

Their team manages payroll and compliance directly with Kazakhstan’s State Revenue Committee, ensuring your taxes, pensions, and contracts are always up to date.

Why Team Up Dominates Central Asia:

Local compliance: Direct filings and bilingual contracts (Kazakh + English).

Flat-rate pricing: €199 per employee/month — no markup, no hidden fees.

Regional reach: Kazakhstan, Uzbekistan, Georgia, Armenia, and beyond.

Employer of record employee benefits in Kazakhstan and contract templates localized to Kazakh labor law.

Bilingual HR support: Real people, not call centers.

Fast onboarding: 3–5 business days from contract to start date.

Best for: Startups, SMEs, and global enterprises hiring across Central Asia and MENA.

“Kazakhstan’s business reforms and growing IT sector are opening new doors for foreign investors, but local compliance is key to success.” — World Bank Doing Business Report, 2025.

Team Up’s approach is designed for companies that want regional scale without the complexity of multiple vendors. One platform. One invoice. Total compliance.

2. Deel

Deel is one of the most recognized global EOR platforms, and for good reason. It’s built for speed, automation, and convenience.

Strengths:

Operates in 150+ countries, including Kazakhstan.

Automated contracts, compliance dashboards, and payroll management.

Integrates with HR tools like BambooHR, QuickBooks, and Workday.

Fast onboarding for global teams.

Limitations:

Relies on local partners for compliance in Kazakhstan.

Support may lack depth in the local language or legal interpretation.

Best for: Global startups managing multiple markets with a tech-first approach.

3. Remote

Remote has made a name for itself as the go-to EOR for startups. It’s simple, transparent, and efficient, everything you want when hiring your first team in Kazakhstan.

Highlights:

Flat pricing with no salary percentage fees.

Onboarding in under a week.

Manages taxes, payroll, and social contributions in Kazakhstan.

Employee benefits and contract templates localized to Kazakh labor law.

Best for: Early-stage companies hiring a handful of employees in Kazakhstan.

4. Papaya Global

Papaya Global isn’t just an EOR; it’s a data powerhouse.

If your company values payroll analytics and automation across countries, this is the enterprise-level option.

Features:

AI-powered compliance monitoring and payroll tracking.

Consolidated payroll view across all countries.

Integrations with ERP and finance systems.

Secure data storage and audit reporting.

Best for: CFOs managing large global teams needing oversight, not just payroll.

5. Velocity Global

When your team mix includes local hires and expatriates, Velocity Global is one of the few providers that can handle both, from work permits to payroll.

What they do well:

Manage residency, visa sponsorship, and relocation for expats.

Handle tax equalization and compliance for global teams.

Combine EOR with global mobility solutions.

Best for: Multinationals transferring staff into Kazakhstan or managing global mobility programs.

6. Multiplier

If your finance or HR team wants clarity over control, Multiplier is worth considering.

It’s built around compliance visibility, giving you live insight into every salary payment, tax filing, and statutory deduction in Kazakhstan.

Why companies use Multiplier:

Single dashboard for payroll, compliance, and HR analytics.

Real-time alerts for tax deadlines and UAPF pension submissions.

Centralized reporting across multiple countries.

Integration with accounting tools like Xero and NetSuite.

Best for: HR and finance teams that want full transparency in payroll operations.

What’s missing:

Multiplier still leans heavily on third-party local providers in Kazakhstan. It’s efficient, but not hands-on.

If your company values local accountability, you’ll find TeamUp’s direct compliance operations far more dependable.

7. Globalization Partners (G-P)

If your company operates across five continents, Globalization Partners (G-P) is a solid enterprise-level solution.

They’ve been in the EOR game for over a decade, with coverage in 180+ countries, including Kazakhstan.

Strengths:

Enterprise-grade security and payroll infrastructure.

Dedicated account management and legal support.

Integration with ERP systems for multinational oversight.

Tailored employee benefits and tax compliance solutions.

Best for: Fortune 500s and multinational enterprises that prioritize process consistency.

Where it falls short:

For smaller or mid-market companies, G-P’s complexity and cost can be excessive.

You’ll get global breadth — but not the localized agility that TeamUp offers.

8. Oyster HR

If your company is remote-first and expanding fast, Oyster HR makes global hiring simple — including in Kazakhstan.

It’s an EOR designed for modern distributed teams, letting you hire employees or convert contractors with ease.

Features:

One-click contractor-to-employee conversion.

Automated global payroll and compliance.

Benefits and equity options for remote workers.

Intuitive dashboard for onboarding and HR management.

Best for: Tech startups and SaaS companies with remote teams across MENA, Europe, and Central Asia.

Caveat:

Oyster operates globally but outsources employer of record compliance in Kazakhstan. That means contracts and filings in Kazakhstan often go through intermediaries, not direct filings with the State Revenue Committee.

If you’re building long-term teams in Central Asia, a regional EOR like Team Up will handle things faster and with more accountability.

9. Safeguard Global

Safeguard Global shines in regulated sectors like energy, oil, and logistics, industries that Kazakhstan is known for.

It focuses on risk management, data protection, and payroll automation for large organizations.

Strengths:

Automated payroll processing and compliance checks.

Enterprise-grade audit trails for tax and legal reviews.

Deep integration with corporate HR systems.

Strong data security (ISO 27001 certified).

Best for: Large corporations or government contractors that need airtight compliance.

Tradeoff:

Safeguard’s enterprise-first approach means setup can be slow. If you’re a fast-moving company hiring in Kazakhstan for the first time, TeamUp’s streamlined onboarding (3–5 days) will feel refreshingly fast.

10. WorkMotion

WorkMotion is gaining traction among European firms hiring nearshore teams in Central Asia.

It offers EU-standard compliance and 72-hour onboarding, making it one of the quickest options for getting started in Kazakhstan.

Why it stands out:

Coverage across the EU + Central Asia.

Flat-rate pricing model.

GDPR-compliant data systems.

Bilingual support (English + Russian).

Best for: European companies building hybrid teams across Kazakhstan, Georgia, and the Balkans.

Limitation:

While fast and secure, WorkMotion’s coverage doesn’t match Team Up’s regional depth — especially if you’re expanding beyond the EU sphere.

Comparison table: Top 10 Employer of Record (EOR) companies in Kazakhstan (2026 overview)

Provider | Coverage | Pricing Model | Best For | Standout Feature |

Team Up | Central Asia, Caucasus, MENA, Eastern Europe | Flat €199 | Regional hiring, startups, SMEs | Local compliance + bilingual HR |

Deel | 150+ countries | % of salary | Remote-first startups | Automation + integrations |

Remote | 100+ countries | Flat | Startups entering Kazakhstan | Speed + simplicity |

Papaya Global | 160+ countries | Custom | Enterprises | Payroll analytics + automation |

Velocity Global | 185+ countries | Custom | Relocations + expats | Immigration + global mobility |

Multiplier | 150+ countries | Custom | Finance & HR teams | Compliance dashboard |

G-P | 180+ countries | Custom | Large enterprises | Enterprise-level control |

Oyster HR | 130+ countries | Flat | Distributed teams | Benefits + equity support |

Safeguard Global | 150+ countries | Custom | Regulated industries | Governance + risk management |

WorkMotion | EU + Central Asia | Flat | EU firms expanding East | Fast onboarding + GDPR compliance |

Comparing Employer of Record (EOR) pricing models in Kazakhstan: Flat vs. percentage-based

Here’s the unfiltered truth: most global EORs charge 10–15% of salary, and those fees compound quickly as your team grows.

In Kazakhstan, where salaries can vary widely between tech and engineering roles, that model gets expensive fast.

Flat-fee pricing, like Team Up’s €199 per employee/month, keeps your hiring predictable, scalable, and budget-friendly.

Pricing Model | How It Works | Example (KZT 1,000,000 salary) | Predictability | Hidden Fees? |

Flat-Fee (Team Up) | Fixed cost per employee | €199 (~KZT 100,000) | Consistent | None |

Percentage-Based (Deel, G-P, Remote) | 10–15% of gross salary | €400–600 (~KZT 400,000–600,000) | Variable | Often yes |

“Flat-rate pricing allows global companies to plan hiring budgets without currency risk or salary-driven inflation.” — PwC Central Asia Payroll Report, 2025.

How to choose the best Employer of Record (EOR) in Kazakhstan

You’re not just choosing a vendor, you’re choosing a compliance partner.

Here’s how to spot the difference between a software provider and a true Employer of Record.

1. Verify they’re legally registered in Kazakhstan

Ask for proof of registration with the Ministry of Labor and Social Protection.

If they can’t show it, they’re outsourcing, and you’ll pay for that gap when the tax office comes knocking.

2. Ask for bilingual contracts (Kazakh/Russian + English)

Under the Kazakhstan Labor Code, all contracts must be in the local language.

Team Up’s dual-language documentation protects you from disputes and ensures local enforceability.

3. Check their payroll infrastructure

They should remit taxes directly to the State Revenue Committee and UAPF, not via a third party.

Payroll delays or incomplete filings are the fastest way to lose compliance status.

4. Demand transparent pricing

If your quote includes “variable admin fees,” it’s a red flag.

A fixed rate like TeamUp’s €199/month is the gold standard for clarity.

5. Test their response time

When something goes wrong, and it will, eventually, you want a local HR team that answers in hours, not days.

Team Up’s bilingual HR managers in Almaty and Tbilisi handle every case personally.

Local vs. global EOR providers in Kazakhstan: Which is right for you?

Global EORs give you reach.

Local ones give you results.

Here’s the difference side by side:

Factor | Local EOR (TeamUp) | Global EORs (Deel, G-P, Remote) |

Compliance Expertise | Deep Kazakh payroll & labor law knowledge | Broad, general frameworks |

Pricing | Flat €199/month | 8–15% of salary |

Contracts | Bilingual (Kazakh/Russian + English) | English only |

Support | Regional, bilingual | Centralized global support |

Onboarding Speed | 3–5 days | 7–14 days |

Coverage | Central Asia, Caucasus, MENA | 100+ countries |

Local Accountability | 100% in-country management | Outsourced partners |

If you’re hiring five engineers in Almaty today and ten more in Tashkent tomorrow, you don’t want five EORs; you want one partner who knows the region inside out.

That’s Team Up.

Final thoughts

Kazakhstan offers a rare combination of affordability, talent, and strategic access to regional markets, but it demands legal precision.

Hiring here without a trusted Employer of Record is like driving cross-country with no map.

That’s why Team Up has become the go-to EOR partner for global companies hiring in Kazakhstan.

With flat-rate pricing, local compliance teams, and regional coverage across Central Asia, the Caucasus, and MENA, TeamUp simplifies everything, contracts, payroll, benefits, and compliance, under one unified system.

Why companies choose Team Up:

3–5 day onboarding process.

Direct filings with Kazakh tax and pension authorities.

Arabic, Russian, Kazakh, and English HR documentation.

Seamless expansion into Uzbekistan, Georgia, Azerbaijan, and Egypt.

It’s not just about hiring, it’s about staying compliant while you scale.

Ready to hire in Kazakhstan without setting up an entity?

Schedule a call with Team Up and see how our EOR services make payroll, compliance, and onboarding effortless, all for one flat monthly rate.

Frequently asked questions

1. What does Employer of Record (EOR) mean?

An Employer of Record (EOR) is a company that legally employs workers on behalf of another business. It manages all HR, payroll, and tax responsibilities, allowing you to hire employees without setting up a legal entity in the country.

In Kazakhstan, using an EOR means you can expand your team quickly while staying fully compliant with local labor laws and tax regulations.

2. What are the best Employer of Record (EOR) companies in Kazakhstan?

The best Employer of Record companies in Kazakhstan combine local compliance expertise with fast onboarding and transparent pricing.

Top-rated EOR providers include:

TeamUp – Best for regional coverage and transparent pricing.

Deel – Strong for global teams and payroll automation.

Remote.com – Ideal for multi-country hiring at scale.

Papaya Global – Best for enterprise-level payroll solutions.

These top EOR companies make hiring in Kazakhstan simple, fast, and fully compliant.

3. How do I choose the best Employer of Record service in Kazakhstan?

When selecting the best EOR service, look for:

A registered local entity in Kazakhstan.

Clear, fixed pricing with no hidden fees.

In-house expertise in Kazakh labor law.

EOR software for payroll tracking and reports.

Fast employee onboarding (within 5–10 business days).

If you’re looking for an EOR, TeamUp stands out for its localized compliance and end-to-end support for global employers hiring in Kazakhstan.

4. What services does an Employer of Record provide in Kazakhstan?

An Employer of Record service in Kazakhstan manages:

Drafting and maintaining employment contracts.

Payroll processing in KZT (Kazakhstani Tenge).

Tax filings, income tax, and social contributions.

Employee benefits management (vacation, sick leave, etc.).

Legal compliance with Kazakhstan’s labor laws.

Essentially, the EOR acts as your local HR and legal partner — while you focus on managing your team.

5. What’s included in Employer of Record payroll services in Kazakhstan?

Employer of Record payroll services cover:

Calculating and paying salaries in KZT.

Deducting income tax (10%) and social contributions.

Filing taxes and insurance payments with Kazakh authorities.

Generating payslips and payroll summaries.

Managing compliance with all local payroll regulations.

With EOR payrolling, everything from tax deductions to employee reporting is handled automatically and compliantly.

6. Why should startups use an Employer of Record in Kazakhstan?

Startups benefit from using an Employer of Record for startups because it helps them:

Hire talent in Kazakhstan without creating a local entity.

Stay compliant with labor, tax, and visa regulations.

Save time and costs on HR administration.

Scale up or down easily as projects grow.

For tech-driven startups expanding into Central Asia, TeamUp is one of the best EOR providers offering local expertise and speed.

7. What makes TeamUp one of the best EOR providers in Kazakhstan?

Team Up is trusted by global companies for its hands-on, transparent, and locally compliant Employer of Record services in Kazakhstan.

Key advantages include:

Registered local entity for full compliance.

Fast onboarding (within a week).

Transparent pricing with no hidden costs.

Local HR and tax experts on the ground.

A user-friendly EOR software platform for payroll management.

That’s why Team Up consistently ranks among the top employer of record companies in the Caucasus and Central Asia.

8. What’s the difference between an EOR and payroll outsourcing?

An EOR acts as the legal employer, responsible for compliance, contracts, and payroll. Payroll outsourcing, on the other hand, only handles payment processing; you still bear the legal and HR obligations.

If you don’t have a local entity in Kazakhstan, you’ll need an EOR solution instead of a payroll-only vendor.

9. Are there global Employer of Record companies operating in Kazakhstan?

Yes. Several global EOR companies cover Kazakhstan, including:

TeamUp – Best for regional focus and personal support.

Deel – Offers automated global payroll.

Remote.com – Strong multi-country coverage.

Papaya Global – Enterprise-grade compliance automation.

These international Employer of Record services help companies manage global hiring from one unified platform.

10. What industries benefit most from EOR services in Kazakhstan?

EOR services are especially valuable in industries like:

Technology and software development.

Energy, mining, and engineering.

Finance and professional services.

Marketing, design, and consulting.

These sectors rely on EOR providers for legal hiring and smooth payroll operations in Kazakhstan’s fast-growing economy.