Why companies are hiring in Azerbaijan?

Azerbaijan isn’t the first market on most global employers’ lists, and that’s the opportunity. The country is home to skilled engineers, competitive salaries, and a growing remote-first culture.

Here’s what makes Azerbaijan worth a serious look:

-

Remote-ready engineers

-

Lower salaries than in Western Europe

-

Full timezone overlap with Europe (UTC+4)

-

High loyalty and retention

-

English proficiency

“salam”

Capital

Currency

Language

Population

Baku

Azerbaijani Manat (AZN)

Azerbaijani (English common in IT sector)

10 Million

Payroll & taxes in Azerbaijan

Employer | Employee | Other |

|---|---|---|

2% Unemployment insurance fund | 25% Income tax rate (for monthly income above 2,500 AZN) | 20% Corporate income tax |

22% Social Insurance contribution | 14% Income tax rate (for monthly income up to 2,500 AZN) | 18% VAT |

3% Social Insurance contribution | 10% Dividends, interest and royalties |

Tailored solutions for growing teams

Recruitment

1 month salary

Talent Search

Fast onboarding & offboarding

Free replacement (3 months)

EOR

from €199/m

Local employment contract

Monthly payroll

Tax and pension reporting

Contractors

from €8/h

10-40 hour workweek per talent

Legally compliant contracts

Fast onboarding and offboarding

Workspace

from €150/m

Flexible or dedicated desk

24/7 access

High speed internet

Equipment

from €69/m

Flexible leasing or buying

Latest tech inventory

Maintenance included

Benefits

from €49/m

Gym membership

Health insurance

Trainings and certifications

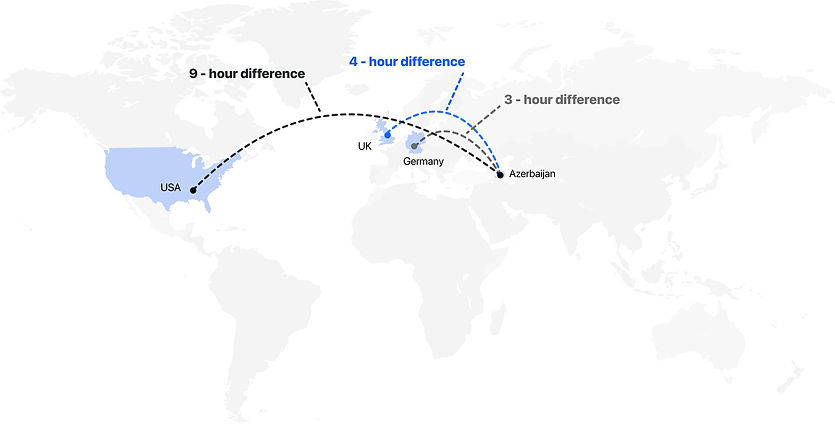

Time zone compatibility in Azerbaijan

Azerbaijan

GMT+4

(No Daylight Saving)

Germany

(GMT+1, GMT+2 in

Daylight Saving)

2-3 hours behind Azerbaijan

UK

(GMT, GMT+1 in

Daylight Saving)

3-4 hours behind Azerbaijan

USA (New York)

(New York, GMT-5, GMT-4 in Daylight Saving)

8-9 hours behind Azerbaijan

Paid leaves

Paid time off

Employees in Azerbaijan are entitled to 21 days after six months of employment

Sick leave

Paid leave based on tenure and social insurance contributions

Public holidays

Azerbaijan recognizes 19 public holidays as listed bellow

Paternity leave

While there is no statutory paternity leave, fathers can take up to 14 days of unpaid leave following the birth of a child

Maternity leave

Female employees are entitled to 126 calendar days of paid maternity leave (70 days before and 56 days after childbirth)

Competitive add-ons we can manage for you:

Everything you need to level up professionally and feel respected, cared for and valued

Health insurance

Comprehensive premium

insurance package

Remote work

Fully remote work with 24/7 access to an office

Equipment

Perfect hardware for tasks of

any complexity

Gym membership

Access to over 300 sports and wellness facilities

Self-development

Professional training and

language courses

Community

Online and offline meetups all

year long

Public Holidays in Azerbaijan

January | March | May | June | July | September | October | November | December |

|---|---|---|---|---|---|---|---|---|

1 New year's day | 8 International women's day | 9 Victory day | 15 National salvation day | 9 Police day | 27 Day of remembrance | 18 Independence day | 8 Victory day | 31 Day of solidarity of world Azerbaijanis |

2 New year's day | 20 Novruz holiday | 28 Republic day | 26 Armed forces day | 9 State flag day | ||||

28 Army day | 21 Novruz holiday | 12 Constitution day |

Ramazan Bayramı

2 Days

Gurban Bayramı

2 Days

Hire in 3 easy steps

Book a meeting

Tell us where you want to hire and who you’re bringing onto your team.

We handle contracts, payroll, and compliance

Your employee is onboarded locally with fully compliant employment documents.

Your team starts working. We manage the admin

You manage the work. We manage the legal side. One monthly invoice, no surprises.

Blog

Get interesting stories about people, projects, and career opportunities directly to your mailbox.

Blog

Discover how an Employer of Record (EOR) in Azerbaijan can help you to hire top talent without a local entity. Learn to manage compliance and reduce costs in 2025.

Blog

Compare flat vs % models and calculate your total cost. Discover what EOR fees in Azerbaijan cover, from payroll and permits to benefits, equipment, and workspace.

Blog

Explore EOR vs entity in Azerbaijan: compare setup fees, EOR pricing, team-size costs, compliance risks, payroll, and benefits to find your leanest hiring path.

FAQ

What is an Employer of Record (EOR) and how does it work in Azerbaijan?

+

How can foreign companies hire employees in Azerbaijan without establishing a local legal entity?

+

What local labor law and payroll compliance obligations does an Employer of Record handle in Azerbaijan?

+

How does an EOR manage taxes, social security contributions, and employee benefits in Azerbaijan?

+

What are the costs and fees for using an Employer of Record service in Azerbaijan?

+

How quickly can an Employer of Record onboard new employees in Azerbaijan?

+

Can an EOR assist with work permits and visa processing for foreign employees in Azerbaijan?

+

What is the difference between an Employer of Record and a Professional Employer Organization (PEO) in Azerbaijan?

+

How does an EOR ensure compliance with Azerbaijani labor and tax laws to mitigate employment risks?

+

Can employees hired through an EOR in Azerbaijan be transferred to a company’s own local entity later?

+

Book a call

How does EOR work in Azerbaijan?

If you're expanding your business into the South Caucasus, understanding how to work with an Employer of Record in Azerbaijan is critical. The EOR model allows foreign companies to legally employ workers in Azerbaijan without establishing a legal entity. In 2025, global hiring strategies are shifting toward flexible models, and using an employer of record in Azerbaijan gives you fast access to skilled talent, regulatory compliance, and reduced operational friction.

%20service%20in%20Azerbaijan.png)