Employer of Record (EOR) vs setting up your own entity in Armenia: Which is better?

- Jul 24, 2025

- 11 min read

Table of contents:

Introduction

You want to hire in Armenia. But do you want the paperwork too?

Because that's what’s waiting if you take the long route. Entity setup. Tax registration. Labor code interpretation. Not to mention months of back-and-forth emails just to get a local bank account working.

At the same time, you don’t want to feel like you’re outsourcing your hiring to some mystery partner halfway across the world. You want control. You want speed. And yeah, you want it all without making a legal mess.

This is where it gets interesting.

Do you go full ownership mode and build from scratch?

Or do you sidestep the bureaucracy and hire through an Employer of Record?

Both paths lead to the same result: a team in Armenia.

But the experience getting there? Night and day.

Let’s break down which one actually makes sense for the business you’re building. Not the one you might build five years from now. The one that needs to hire someone this month.

What is an Employer of Record in Armenia?

Let’s say you’ve found a great candidate in Armenia.

You’re ready to hire. The team’s excited. The project can’t wait.

But here’s the problem: You don’t have a legal entity in Armenia. You don’t know the first thing about Armenian labor law. And you definitely don’t want to mess up payroll, benefits, or tax compliance in a country you’ve never operated in before.

So what do you do?

You use an Employer of Record.

The short version?

An Employer of Record (EOR) in Armenia is a third-party company that legally employs your team on your behalf.

They handle all the backend complexity, contracts, payroll, taxes, and compliance, while you focus on running your business and managing your people.

What does an EOR actually do?

Here’s what a trusted EOR in Armenia takes care of:

Local employment contracts

The EOR signs contracts directly with your employee, based on terms you define. The contract is:

Compliant with Armenian labor law

Written in Armenian (as required)

Legally binding and enforceable

You decide salary, role, probation, bonuses, benefits—just like you would with any direct hire.

Payroll processing & tax filings

The EOR:

Calculates monthly gross-to-net salaries

Withholds and pays Armenian income tax (usually 20%)

Handles social contributions (including pension and health, if applicable)

Ensures full payroll tax compliance with local authorities

All you do is fund one monthly invoice. No registrations. No filings. No risk.

Employee benefits & local compliance

A good EOR makes sure your hires get:

The legally required paid holidays (public holidays + 20 days leave)

Sick leave policies that follow Armenian law

Optional add-ons like equipment, insurance, bonuses, etc.

They also handle:

Terminations (with proper notice/pay)

Employee protections

Data privacy laws

Visa and work permit guidance, if needed

Ongoing HR support

Your EOR acts as your boots-on-the-ground HR partner.

They provide onboarding, documentation, updates on policy changes, and act as your employee’s point of contact for anything legal/payroll-related.

Setting up your own entity in Armenia

Let’s be honest, setting up your own legal entity sounds impressive. It signals commitment. It gives you full control. And for some companies, it’s the right move.

But if you’re picturing a quick online form and a welcome email from the Armenian government… no. That’s not how this works.

Setting up an entity in Armenia comes with paperwork, deadlines, fees, and a lot of “wait, who do I email about this?” moments.

Still interested? Good. Here’s how it works.

Step 1: Choose your structure

Most foreign companies choose an LLC (Limited Liability Company). It’s flexible, scalable, and relatively straightforward to set up. You’ll need:

A local legal address

At least one founder (can be foreign)

A founding document (charter)

A local director (can also be foreign)

A bank account

Step 2: Register the company

You’ll file your documents with the State Register of Legal Entities. Processing usually takes 1–3 business days if everything is in order.

But here’s the kicker:

All documents must be in Armenian and notarized. If you're not in-country, you’ll likely need a local legal partner or Power of Attorney to handle this for you.

Step 3: Register with tax authorities

After your entity is registered, you’ll need to:

Obtain a Taxpayer Identification Number (TIN)

Register with the State Revenue Committee

Set up local payroll systems

Begin filing monthly tax and social security reports, even if you haven’t hired anyone yet

This is where most companies realize: setting up an entity is just the beginning.

Step 4: Open a business bank account

Some banks require in-person visits. Others may accept remote applications, but usually with a local legal rep involved.

Expect KYC reviews, translated documents, and a few rounds of back-and-forth.

Cost comparison: EOR vs entity in Armenia

Let’s cut the fluff. You’re here because you want to hire in Armenia, but you’re not looking to throw money into a black hole.

So here’s what you really need to know:

EORs cost more per person. Entities cost more to set up and run.

The question is: what’s the break-even point? And what are you paying for, exactly?

Let’s break it down.

What does an EOR cost in Armenia?

At Team Up, our cost to EOR in Armenia starts at €199 per employee/month. That fee includes:

Employment contracts

Payroll processing

Tax withholding & social contributions

Leave tracking

HR documentation

Onboarding & offboarding

No setup fees. No long-term commitments. No hidden extras.

Sample monthly costs:

Employees | Monthly Cost (€199/employee) | Annual Cost |

1 | €199 | €2,388 |

5 | €995 | €11,940 |

10 | €1,990 | €23,880 |

You pay one invoice. We take care of the rest. That’s it.

What does setting up your own entity cost in Armenia?

Here’s where it gets more complicated and expensive.

Initial setup costs:

Legal support & translation: €500–€1,000

Company registration: ~€100

Notary fees & Power of Attorney: €150–€300

Bank account setup: varies

Estimated total setup: €750–€1,500

Monthly ongoing costs:

Local accountant: €150–€300/month

Payroll & HR admin: €75–€150/month

Software or tools: ~€50/month

Annual filings and tax reporting

Your own time (or your lawyer’s hourly rate)

You’re looking at €275–€500/month just to keep the lights on—before hiring anyone.

Plus:

You handle all compliance

You manage contracts & terminations

You’re legally liable for errors

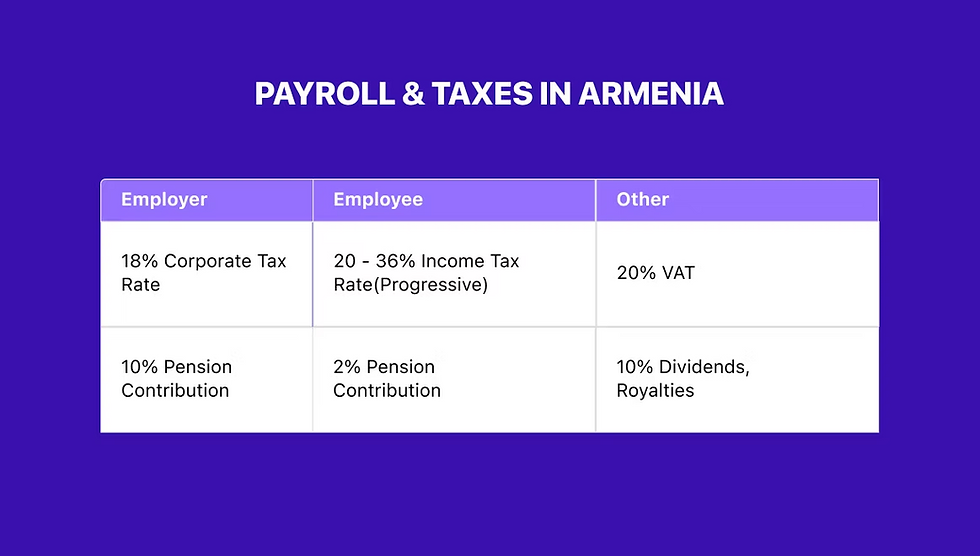

Payroll tax comparison

Whether you use an EOR or your own entity, payroll taxes in Armenia must be handled correctly:

Income Tax: 20% flat

Pension Contributions: Mandatory for residents under 40

Reporting: Monthly, via Armenia’s online tax portal

With an EOR, that’s all automated. With your own entity, it’s all on you (or your accountant).

Talent acquisition & payroll in Armenia

Armenia’s got talent, seriously.

From backend devs and QA testers to support agents and designers, the Armenian talent pool is one of the most underrated in the region. You’re getting technically skilled professionals, most with international experience, fluent in English or Russian, and at a fraction of what you’d pay in Western Europe or the U.S.

So, how do you tap into that talent pool without stepping on legal landmines?

Accessing the Armenian talent pool

If you're hiring through an Employer of Record (EOR), you’re not just getting payroll support; you’re also unlocking access to a network that’s already built.

At Team Up, we work with vetted local recruiters and have an inside track on what roles are in demand, how to structure competitive offers, and how to onboard fast.

No guesswork. No long timelines. Just great people, ready to work.

With your own entity, you’ll be starting from scratch:

Building your employer brand

Sourcing talent through local platforms

Navigating contracts, offer letters, and negotiations solo

Not impossible, but definitely slower.

Payroll processing in Armenia: What changes?

Payroll in Armenia is straightforward, but only if you know the system.

With an EOR:

You approve one invoice

Your employee gets paid correctly, on time, in AMD

We handle:

Income tax (20%)

Pension contributions (for eligible workers)

Payslip generation

Monthly reporting to the State Revenue Committee

You don’t need to register anywhere. You don’t even need to speak Armenian.

With your own entity:

You’ll need a local accountant

You must register with the tax authority and submit reports monthly

You’re responsible for calculating, withholding, and paying:

Income tax

Pension contributions

Any additional benefits or allowances

One missed deadline = penalties.

One misclassification = legal risk.

So what’s the smarter play?

If you're building a long-term base in Armenia with a local team, setting up your own payroll may eventually make sense.

But if you’re trying to move fast, stay compliant, and avoid spending your weekends learning Armenia’s tax portal?

You’ll want a partner who already knows the system.

That’s what an EOR gives you. Talent + payroll done right.

Compliance & legal risk for remote employees hired through an Employer of Record in Armenia

Hiring remotely doesn’t mean hiring casually. Especially not in Armenia.

Because the moment you onboard someone, contractor or employee, you’re no longer just managing a person. You’re managing risk.

And if you get it wrong? It’s not just your contractor who’s exposed. It’s your company.

The risk of misclassification

Let’s say you hire a developer in Armenia as an “independent contractor.” They work 40 hours a week. You manage their schedule, review their work, give them bonuses, and send them a fixed monthly payment.

That’s not a contractor. That’s an employee.

And if the Armenian authorities (or your contractor) decide to challenge that classification, you're on the hook for:

Back taxes

Social contributions

Fines

Reputational risk

And potentially getting banned from hiring locally

This is the # 1 legal mistake international companies make when hiring in Armenia.

Local laws around contracts, taxation, and social security

Armenia’s Labor Code doesn’t leave a lot of gray area. If you're hiring someone for ongoing work, they need:

A written employment contract (in Armenian)

Registered salary payments

Correct tax withholding (20%)

Contributions to the pension system

Paid vacation and leave entitlements

It’s not optional, and it’s not something you can ignore just because you’re based in another country.

Without the right legal setup, you’re violating Armenian labor and tax law. That opens you up to audits, financial penalties, and potentially freezing your ability to hire again.

How an EOR keeps you protected

Using an Employer of Record in Armenia eliminates this risk.

Why?

Because the EOR becomes the legal employer. They:

Sign fully compliant contracts with your employees

Handle tax filings and social security payments

Track leave, probation periods, and statutory benefits

Stay on top of labor law changes—so you don’t have to

You stay focused on managing the work.

They stay focused on keeping it legal.

Benefits, workspaces & equipment policies for employees hired via EOR in Armenia

Hiring someone remotely is easy.

Supporting them like a real employee? That’s where most companies drop the ball.

If you’re hiring in Armenia through an Employer of Record (EOR), benefits, workspace, and equipment aren’t just add-ons; they’re the difference between someone who sticks and someone who quits in six months.

So let’s make sure you get this part right.

What benefits must be provided in Armenia?

Under Armenian labor law, full-time employees are entitled to a baseline set of benefits. Your EOR partner is responsible for making sure these are delivered, and you don’t end up in legal hot water.

Here’s what’s mandatory:

Paid annual leave: 20 working days per year (plus public holidays)

Sick leave: Paid, if certified by a doctor

Parental leave: Up to 140 days of paid maternity leave, plus additional unpaid leave if needed

Pension contributions: Required for employees under 40

Severance pay: Based on tenure and reason for termination

Public holidays: Employees are entitled to all official non-working days

A quality EOR will bake all of this into the employment contract from day one. No surprises. No “oops, we forgot the pension.”

Workspace options for remote EOR employees in Armenia

Do EOR employees work remotely in Armenia? Most do.

But that doesn’t mean you leave them floating in a vacuum. Your EOR provider in Armenia can help you offer:

Coworking stipends – Cover desk space in Tbilisi, Yerevan, or wherever they’re based

Home office budgets – Help them get set up properly (desk, chair, monitor)

Hybrid options – For teams building out hubs or regional offices

Whether they’re in a kitchen corner or a coworking space, the goal is the same: make them feel like a real part of your team, not just a freelance line item.

Equipment policies: Who buys what?

This is the conversation that gets awkward when it’s not handled upfront.

With an EOR, you can decide whether you or the EOR provides the equipment. Some clients prefer to send company laptops; others prefer local purchase and reimbursement.

Policy clarity matters. You’ll want your EOR to define:

Who owns the equipment?

What happens if the employee leaves

Whether repairs or upgrades are covered

At Team Up, we build this directly into the onboarding process because no one likes having this debate after the first Slack outage.

EOR vs PEO in Armenia

Let’s clear something up: EOR and PEO are not the same thing.

They get tossed around like interchangeable acronyms, but if you mix them up in Armenia, you’ll end up with a hiring strategy that doesn’t work, and a compliance problem you didn’t ask for.

So here’s what you need to know.

What’s an EOR?

An Employer of Record (EOR) is a company that legally employs talent on your behalf. You manage the person, and the EOR handles the legal stuff, contracts, payroll, taxes, benefits, and compliance. No need for a local entity. No long setup.

In Armenia, this is the fastest way to legally hire someone without getting buried in labor law or tax registration paperwork.

What’s a PEO?

A Professional Employer Organization (PEO) is different. It’s a co-employment model. That means:

You still need to have a legal entity in Armenia

The PEO helps manage HR admin and compliance, but you share legal responsibility

If something goes wrong, you still carry the risk

Spoiler: Most foreign companies don’t qualify to use a PEO in Armenia because they don’t have a registered local entity.

EOR vs PEO in Armenia: Quick table

Feature | EOR | PEO |

Legal employer | EOR | You (shared with PEO) |

Local entity required | No | Yes |

Payroll & tax compliance | Fully managed by EOR | Supported, but your risk |

Contracts & labor law liability | Handled by EOR | Shared responsibility |

Best for... | Testing markets, fast hiring | Local entity with HR support |

So, which one do you actually need?

If you don’t have a legal entity in Armenia

You can’t use a PEO. You need an EOR.

If you have already set up a company and want admin help

A PEO might work, but you still own the risk.

At Team Up, we focus on EOR solutions because they remove the barriers.

No red tape. No co-employment confusion. Just fast, legal hiring that scales with your team.

Hiring in a new country is hard enough. Don’t complicate it by choosing the wrong model.

Making the right call

So here you are, stuck between two paths.

Option A: Set up your own entity in Armenia. Build the infrastructure. File the paperwork. Hire a lawyer, an accountant, and maybe learn a bit of Armenian labor law while you’re at it.

Option B: Work with an EOR and start onboarding talent next week.

Both are legitimate. Both work. But they serve different goals and different stages of growth.

Choose EOR if…

You need to hire quickly

You don’t want to deal with tax filings, social contributions, or compliance audits

You’re testing the Armenian market or expanding without a long-term commitment

You’re building a lean, remote-first team

You want someone else to carry the legal liability

EOR is perfect for startups, scale-ups, and companies that want to move fast without getting buried in admin.

Choose entity setup if…

You’re building a permanent local presence

You plan to hire 20+ employees in the next 12–18 months

You have in-house legal, HR, and finance capacity

You want full control over payroll, contracts, and operations

You’re ready for a slower setup in exchange for long-term savings

Opening an entity is a long game. If that’s your move, do it right. If not? Don’t get stuck in the process when what you really need is people.

Conclusion

Hiring in Armenia isn’t a legal checkbox. It’s a strategic move. And the way you structure that move, EOR vs. entity, shapes everything that follows: speed, risk, cost, scalability.

An Employer of Record helps you hire in days, stay compliant, and keep your team lean.

A legal entity gives you full control, but it demands time, budget, and a local team to keep things moving.

If you're still stuck wondering which path is best, that’s actually a good sign. It means you’re thinking ahead. You’re not just hiring; you’re building something. And building smart means asking questions before spending money.

So let’s talk.

At Team Up, we don’t push one solution; we help you find the one that fits. Whether you're hiring your first developer or launching a full operation in Yerevan, we’ll give you the real picture: cost, risk, timeline, and all the not-so-obvious things that could trip you up.

Book a free call with our team.

Bring your roadmap. Bring your hiring plan.

We’ll bring the answers.