Employer of Record (EOR) vs payroll outsourcing in Kazakhstan: What’s the difference?

- Aug 29, 2025

- 7 min read

Table of contents:

Quick definitions you can act on

What’s the real difference between hiring through an EOR and running payroll in Kazakhstan, and which one actually protects your business?

If you’re weighing these two models, it usually means one thing: you’re hiring, but you’re not sure who should hold the liability. Here’s what each path really means.

An EOR is the legal employer on record in Kazakhstan.

You manage the day-to-day work. The EOR handles everything tied to employment law.

What the EOR takes care of:

Employment contracts and onboarding

Monthly payroll, tax, and social filings

Statutory benefits and compliance

HR recordkeeping

Lawful terminations and offboarding

Immigration support for residence-permit-based hires

No entity required. No waiting on registration. No admin stack.

Payroll outsourcing:

You remain the legal employer.

The provider just processes payroll for your existing Kazakhstani entity.

What they handle:

Gross-to-net payroll calculations

Payslips, tax withholdings, and monthly filings

Payroll reports and submissions

What stays with you:

Drafting contracts and managing HR

Handling disputes, terminations, and legal filings

Carrying the compliance risk

So which one fits your team and timeline? Keep reading, we’ll break down legal responsibility, compliance risk, costs, and how fast each model gets your first hire up and running.

How does the legal responsibility differ between EOR and payroll outsourcing in Kazakhstan?

This is where the models stop looking similar. Payroll and EOR might both “get people paid,” but only one of them signs the employment contract, and that changes everything.

EOR: You manage the work, they own the risk

With an Employer of Record in Kazakhstan, the EOR is the legal employer.

You handle deliverables, deadlines, and performance. The EOR handles the legal and compliance checklist in Kazakhstan.

They are responsible for:

Drafting and issuing compliant employment contracts

Payroll processing, tax filings, and social contributions

Administering statutory benefits

Managing lawful terminations

Maintaining HR records

Responding to audits or investigations from local authorities

If something goes wrong on the legal side, it’s the EOR’s problem, not yours.

Payroll outsourcing: The admin help, not the shield

In this model, you are the employer. The payroll provider simply runs the numbers.

They will:

Calculate gross-to-net

File monthly payroll taxes

Issue payslips

Provide standard payroll reports

But you still own:

Employment contracts and HR documentation

Disciplinary processes, disputes, and exits

Compliance with the Kazakhstan labor law

Any fines or legal fallout if things go sideways

What about PEOs?

A PEO uses a co-employment structure

You still need a registered local entity

You share HR admin, but you remain the legal employer

A PEO does not remove legal risk or employer responsibility the way an EOR does

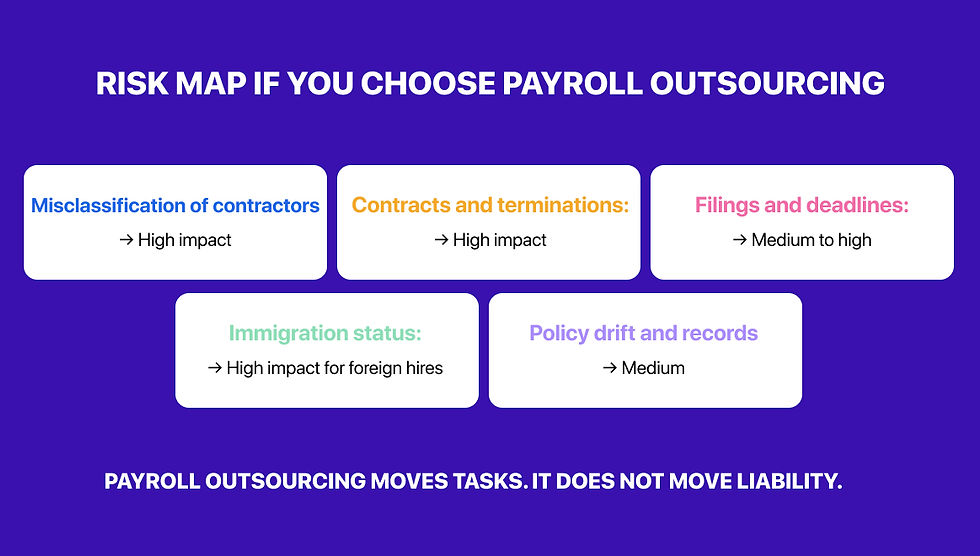

Key legal risks if you choose payroll outsourcing instead of EOR in Kazakhstan

Payroll outsourcing sounds safe. You get the numbers filed, taxes calculated, and salaries sent. But here’s the catch: you’re still the legal employer, and that means you carry the liability.

Here are the risks companies overlook until they’re dealing with fines, audits, or worse.

Misclassification: contractor-first pitfalls

Trying to start lean by hiring freelancers instead of full-time employees? In Kazakhstan, that’s a red flag.

If a contractor works like an employee, with fixed hours, long-term, and integrated into your team, they can be reclassified.

Reclassification means back taxes, unpaid social contributions, and penalties.

The payroll provider isn’t on the hook. You are.

Audit exposure, penalties, and legal fallout

Payroll outsourcing doesn’t remove your name from the legal paperwork.

If contracts are non-compliant or HR policies are outdated, you face the fines.

The vendor submits payroll filings—but if they’re late or wrong, you still answer to authorities.

During a labor audit, the Ministry isn’t knocking on the payroll provider’s door. They’re calling you.

Task handoff is not a liability transfer

This is the bottom line:

Payroll outsourcing helps with execution.

It does not own compliance.

You’re still legally accountable for contracts, terminations, disputes, and employment law violations.

An EOR, on the other hand, is the legal employer. They issue contracts, manage payroll filings under their name, and absorb employer risk in Kazakhstan.

Cost comparison, you can budget

Let’s make this simple: EOR costs more per head, but payroll outsourcing costs more to run. The right model comes down to how many people you're hiring, how long you plan to stay, and how much legal admin you're willing to carry.

EOR pricing in Kazakhstan

With an Employer of Record, you’ll typically pay a monthly, per-employee fee. That fee includes:

Local employment contracts

Payroll processing + tax and social filings

Benefits administration (health, pensions, vacation, sick leave)

HR documentation and compliance

Lawful offboarding and terminations

Immigration support for foreign hires

No setup fees. No separate legal fees. No in-house compliance team required.

Payroll outsourcing costs

Payroll outsourcing looks leaner at first—but only if you already have a registered entity.

You’ll be paying for:

Initial entity setup in Kazakhstan (registration, tax ID, banking)

Monthly payroll administration fees

Internal HR/legal resources to manage contracts, compliance, and labor law

Ongoing updates to policies, terminations, and filings

And if something goes wrong, you eat the fine, not the payroll vendor.

Break-even guidance

1–3 hires or short-term roles? EOR is cheaper, faster, and cleaner.

5+ full-time, long-term hires? Owning an entity + payroll might save money if you have local HR/legal muscle.

How quickly can you establish or switch between EOR and payroll?

Speed matters, especially when you’ve got talent on standby or deadlines to hit. If you’re trying to decide between EOR and payroll outsourcing in Kazakhstan, the timeline to hire might be your biggest deciding factor.

EOR onboarding: fast and clean

With an EOR, onboarding can happen in just a few business days.

No need to register a local entity

No banking, tax registration, or labor office paperwork

The EOR handles contracts, benefits, payroll, and work permits, visas & immigration

You approve the offer, and they handle the rest

For urgent hires or market tests, this is your fastest legal option.

Payroll setup: 4–6+ weeks

Setting up an entity and registering for payroll in Kazakhstan isn’t instant.

You’ll need to:

Register a local legal entity

Open a corporate bank account

Obtain tax and social contribution IDs

Finalize employment contracts and HR policies

Onboard with a payroll processor

It’s not unmanageable, but definitely not immediate.

Switching between models

Payroll → EOR: Terminate the employment contract under your entity and rehire through the EOR. If handled correctly, benefits and seniority can carry over.

EOR → Payroll: Once your local entity is ready, novate the contract to your business. You’ll then take over all employer obligations directly.

What scenarios make EOR the better choice?

If you're trying to hire in Kazakhstan without a local setup and without legal risk, it’s hard to beat the simplicity of an Employer of Record.

Here’s when EOR is the clear winner:

You don’t have an entity and need to hire now

Setting up a legal entity in Kazakhstan takes time, paperwork, and in-country coordination. If you're eyeing a quick hire or testing the market, an EOR can get your employee onboarded in days, no tax registration, no bank accounts, and no delay.

You’re hiring foreign talent who need residence/work permits

Kazakhstan’s immigration rules can be strict.

The EOR acts as the legal sponsor for your foreign hires.

They handle permit applications, local registrations, and employer obligations tied to immigration.

You stay compliant without taking on the red tape.

You want one invoice and no admin headaches

With EOR, you're not juggling multiple vendors or running HR out of spreadsheets.

You get:

A legally compliant employment contract

Monthly payroll and benefits filings

Social contributions and tax submissions

A single invoice for all of it

When payroll outsourcing is enough

Payroll outsourcing works if you’ve already done the hard part. That means registering a local entity in Kazakhstan and building the internal muscle to manage compliance.

Here’s when payroll outsourcing makes sense:

You already have a legal entity in Kazakhstan

You’ve gone through the setup. Your company is registered. Tax and social contributions are in place. You don’t need a legal employer; you just need help calculating payroll and submitting filings.

You’re comfortable owning HR and compliance

Payroll providers don’t handle:

Drafting contracts

Updating policies

Managing terminations

Dealing with audits

If your team can handle local labor law, employment disputes, and administrative reporting, you don’t need an EOR; you just need solid payroll support.

Your headcount is stable and permanent

EOR fees scale per employee. If you’ve got 5+ long-term hires, the cost of running payroll in-house or through a processor often becomes more attractive.

When the infrastructure is already built, outsourcing payroll can help you stay lean without giving up control. But if you're not there yet, or you’re unsure about compliance? EOR is still the safer move.

Comparison table

If you’re still undecided, here’s a side-by-side breakdown of the four main hiring models in Kazakhstan: EOR, Payroll Outsourcing, PEO, and setting up your own legal entity, so you can see exactly what you’re signing up for.

Feature | EOR | Payroll Outsourcing | PEO | Own Entity |

Legal employer | EOR | You | You | You |

Entity required | No | Yes | Yes | Yes |

Time to start | 1-2 days | 4–6+ weeks | 4–6+ weeks | 6–8+ weeks |

Compliance owner | EOR provider | You | You | You |

Immigration support | Included | Not included | Varies | Requires setup |

Cost model | Per employee per month | Monthly admin + setup | Monthly admin + co-employment fee | Entity setup + ongoing ops |

Risk exposure | Minimal | High | High | You own it all |

Conclusion

EOR and payroll outsourcing in Kazakhstan may look similar from the outside, but under the hood, they serve very different business needs.

If you need to hire fast, skip the entity setup, and avoid getting tangled in labor law, EOR gives you a clean, compliant path forward with one invoice, one contract, and no legal exposure.

If you’ve already built local infrastructure and you’re confident managing contracts, policies, and terminations, payroll outsourcing can cut admin without giving up control. But make no mistake, you carry the risk.

Not sure which path fits your team?

Get a Kazakhstan hiring plan in 24 hours with side-by-side cost, timeline, and compliance risk mapped to your actual headcount. We’ll show you exactly where EOR wins and where payroll makes sense.