PEO vs Employer of Record (EOR) in Kazakhstan: Which is right for your organization?

- Natia Gabarashvili

- Oct 6, 2025

- 12 min read

Updated: Oct 17, 2025

Table of contents:

Introduction: Understanding PEO vs Employer of Record (EOR) in Kazakhstan

Key differences between Employer of Record and PEO in Kazakhstan

Benefits and risks of using Employer of Record vs PEO in Kazakhstan

Cost analysis of Employer of Record and PEO services in Kazakhstan

Operational considerations in Kazakhstan: Payroll, benefits, equipment, and workspace

Employees vs contractors via Employer of Record and PEO in Kazakhstan

Choosing between PEO and Employer of Record for your Kazakhstan hiring needs

Introduction: Understanding PEO vs Employer of Record (EOR) in Kazakhstan

Hiring in Kazakhstan comes with its own set of challenges and opportunities.

Two models you’ll hear about a lot are PEO (Professional Employer Organization) and Employer of Record (EOR).

Both can help you manage employees, but they work very differently, and picking the wrong one can cost time, money, and compliance headaches.

A PEO operates under a co-employment model. Your company remains the legal employer, while the PEO handles payroll, benefits administration, and HR tasks. The catch? To use a PEO in Kazakhstan, you must already have a local legal entity. No entity, no co-employment, no PEO.

An EOR, in contrast, becomes the legal employer on your behalf. They issue contracts, manage payroll and taxes, ensure social contributions, and provide statutory benefits, while you manage the employee’s day-to-day work. For companies that want to hire quickly in Kazakhstan without setting up a local entity, the EOR is often the practical solution.

In this article, we’ll cover:

The core differences between PEO and EOR in Kazakhstan

Cost and operational considerations

Compliance requirements and payroll management

How these models handle employee benefits, equipment, and workspace

By the end, you’ll have a clear understanding of which model fits your business goals, allowing you to scale efficiently, stay compliant, and hire the right talent without friction.

What is an Employer of Record (EOR) and PEO in Kazakhstan?

If you’re hiring in Kazakhstan, understanding the distinction between a PEO and an Employer of Record (EOR) is more than a matter of semantics; it’s a matter of compliance, speed, and risk management.

Employer of Record (EOR) in Kazakhstan

An EOR provider in Kazakhstan is a service provider that legally employs your staff on your behalf. The EOR assumes all legal obligations for the employees while you manage their day-to-day work. In practice, this means:

Employment Contracts: The EOR issues locally compliant, enforceable contracts under Kazakh labor law.

Payroll Management: Handles salary payments, income tax withholding, and social security contributions.

Compliance: Ensures adherence to labor regulations, files taxes and contributions on time, and manages statutory benefits.

Benefits Administration: Provides statutory benefits like paid leave, social insurance, sick leave, and maternity protection.

Legal Liability: The EOR assumes the legal risk as the employer, shielding your company from fines or audits.

Essentially, an EOR lets you hire legally without setting up a local entity in Kazakhstan, making it the go-to solution for foreign companies entering the market.

Professional Employer Organization (PEO) in Kazakhstan

A PEO provides HR support under a co-employment model. Your company remains the legal employer, while the PEO handles payroll, benefits administration, and other HR tasks.

What does peo stand for in Kazakhstan:

Employment: You remain the legal employer, so compliance liability stays with your company.

Payroll & Benefits: The PEO can process payroll and administer benefits, but you are ultimately responsible for legal compliance.

Compliance Support: PEOs provide guidance on local labor law, but errors or omissions are your responsibility.

Entity Requirement: A PEO only works if your company has a registered local entity in Kazakhstan.

The difference between PEO and EOR in the service scope

Service / Responsibility | EOR Kazakhstan | PEO Kazakhstan |

Legal Employer | EOR assumes full legal responsibility | Your company remains the legal employer |

Payroll Management | Fully handled and compliant | Admin support; liability stays with your company |

Compliance & Tax Filings | EOR handles all filings and statutory compliance | Advisory only; compliance risk remains with your entity |

Employee Benefits | Provides statutory and optional benefits | Admin support only; company liable for compliance |

Entity Requirement | No entity required | Local legal entity required |

Risk Exposure | Minimal for your company | Full liability remains with your company |

In short, if you don’t have a local entity in Kazakhstan, EOR is the only compliant and practical way to hire. A PEO is only viable for companies that already have a legal presence and are ready to take on compliance responsibility themselves.

Key differences between PEO and EOR in Kazakhstan

When hiring in Kazakhstan, the difference between a PEO and an Employer of Record (EOR) isn’t just a matter of terminology; it defines who’s legally responsible, who manages payroll, and how your employees are treated. Understanding these distinctions is critical for avoiding compliance issues and operational headaches.

1. Legal employer responsibilities and compliance

EOR: The EOR is the legal employer, taking on full responsibility for employment contracts, labor law compliance, payroll taxes, and statutory benefits. This protects your company from fines, audits, and misclassification risks.

PEO: Your company remains the legal employer. The PEO can provide HR support and payroll administration, but all compliance liability stays with your entity. If something goes wrong, it’s your company that will be accountable.

2. Payroll processing

EOR in Kazakhstan: Handles payroll completely, salary calculation, tax withholding, social security contributions, and reporting. Finance teams get one predictable invoice covering all employee-related costs.

PEO in Kazakhstan: Offers payroll support, but the responsibility for accuracy and legal filings remains with your company. Any mistakes in payroll or tax reporting are your liability.

3. Employee benefits

EOR: Provides full statutory benefits in Kazakhstan, including paid leave, social insurance, sick leave, and maternity protection. Optional benefits, like health insurance or allowances, can also be included.

PEO: Supports benefits administration but does not assume compliance responsibility. Your company must ensure that statutory benefits are delivered according to the Kazakh labor law.

4. Equipment policies

EOR: Can manage equipment provisioning for employees, including laptops, monitors, and other tools, ensuring staff are set up properly, even if your company doesn’t have a local office.

PEO: Usually advisory only. Your company provides and manages equipment, which can complicate logistics if you don’t have a local entity or infrastructure.

Employer of Record vs PEO in Kazakhstan: Comparison table

Function / Responsibility | EOR Kazakhstan | PEO Kazakhstan |

Legal Employer | EOR assumes full legal responsibility | Your company remains a legal employer |

Compliance & Risk | Fully handled by EOR | The company retains liability |

Payroll Management | Managed by EOR; fully compliant | Admin support; errors remain the company's liability |

Employee Benefits | Statutory + optional benefits managed | Admin support; compliance responsibility stays with the company |

Equipment Provisioning | Provided/administered by EOR | The company provides: PEO may advise |

Entity Requirement | No entity required | Local entity required |

Benefits and risks of using Employer of Record vs PEO in Kazakhstan

Hiring in Kazakhstan is full of opportunities and potential headaches. Choosing between a PEO and an Employer of Record (EOR) can determine whether your expansion is smooth or a regulatory minefield. Here’s a practical breakdown.

Benefits of using an Employer of Record in Kazakhstan

Access to the Talent Pool: Kazakhstan’s labor market is growing fast, particularly in tech, finance, and professional services. An EOR lets you hire legally without setting up a local entity, giving you access to top local talent immediately.

Reduced Legal Risks: The EOR becomes the legal employer, taking responsibility for contracts, payroll, taxes, and statutory benefits. This significantly lowers your exposure to fines, audits, and misclassification claims.

Simplified Hiring Process: From onboarding to payroll processing, the EOR manages administrative and legal obligations. You focus on managing employees, not navigating Kazakhstan’s labor laws.

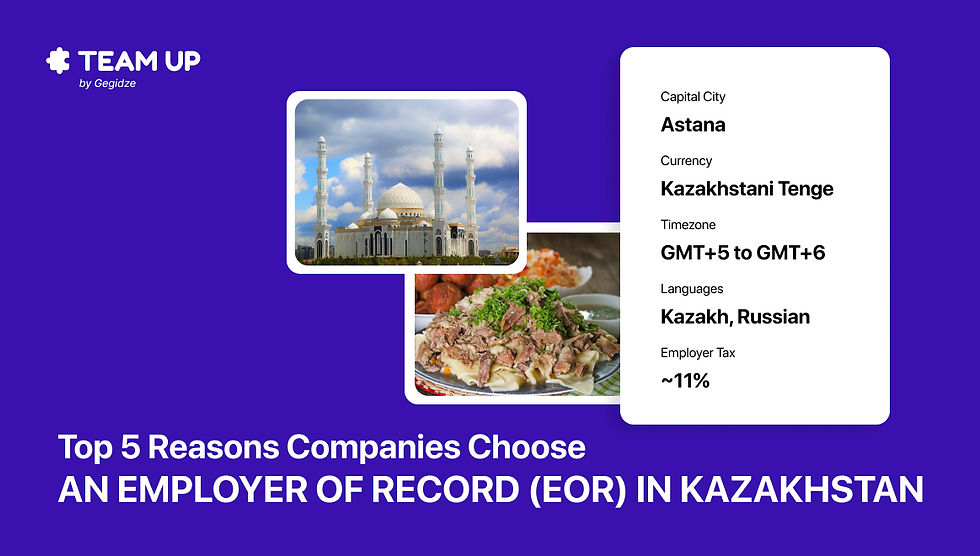

For a deeper dive into the benefits of EOR services in Kazakhstan, see our Top Reasons Companies Choose an Employer of Record (EOR-08).

Professional Employer Organization pros and cons in Kazakhstan

benefits of using a peo:

Provides HR and payroll support while keeping your company as the legal employer.

Useful if you already have a local entity and want administrative help.

Disadvantages of using a peo:

Compliance liability remains with your company. Payroll mistakes, tax misfilings, or benefits errors are your responsibility.

Entity requirement: A PEO cannot legally hire staff on your behalf without a registered company in Kazakhstan.

Limited flexibility for remote-first teams or short-term pilot hires.

Legal risks of hiring without an Employer of Record

Hiring directly in Kazakhstan without a local entity or EOR exposes your business to several risks:

Misclassification: Treating employees as contractors can trigger backpay claims, fines, and audits.

Non-compliance: Payroll, taxes, social contributions, and benefits may be incorrectly administered, risking penalties.

IP and contract issues: Without properly structured contracts, intellectual property and legal protections may not hold.

An EOR mitigates these risks, providing a compliant, fast, and flexible way to hire employees in Kazakhstan without creating a local entity.

Cost analysis of Employer of Record VS PEO services in Kazakhstan

Let’s get practical. If you’re expanding into Kazakhstan, understanding how much it costs to hire legally can make the difference between a smooth launch and a budget headache. The costs for an Employer of Record (EOR) and a PEO can look similar at first glance, but the devil is in the details.

Employer of Record costs in Kazakhstan

An EOR typically charges a flat, all-inclusive monthly fee per employee, covering payroll, taxes, social contributions, and statutory benefits. For example, many providers in Kazakhstan set the EOR service fee around €199 per employee per month on top of the base salary.

What this covers:

Payroll processing: salary calculation, income tax withholding, and social security contributions

Compliance management: ensures all filings meet the Kazakh labor law

Employee benefits administration: statutory benefits like paid leave, social insurance, sick leave, and maternity protection

The key advantage is predictable costs. Finance teams receive one invoice that includes all employment-related expenses, reducing surprises and simplifying budgeting.

PEO Pricing in Kazakhstan

PEO services are usually structured either as:

A percentage of the employee’s salary, or

A flat monthly fee per employee

While PEOs may appear cheaper upfront, the legal liability remains with your company. Additional costs can creep in if you need compliance support, benefits administration, or other HR services not included in the standard package. Multiple invoices and variable fees make budgeting more complicated compared to an EOR.

Factors affecting pricing

Whether you choose a PEO or an EOR, pricing in Kazakhstan can fluctuate depending on:

Payroll size and complexity: Larger teams or higher salaries increase total costs.

Benefits offered: Statutory benefits are mandatory, but optional perks like private health insurance or equipment allowances add to the price.

Compliance support: The level of regulatory guidance, tax filing, and reporting included affects cost.

In short

EOR: Predictable, all-in fee, full compliance handled, single invoice for payroll, taxes, and benefits.

PEO: Potentially lower initial fees if you already have a local entity, but liability and extra costs remain with your company.

Operational considerations in Kazakhstan: Payroll, benefits, equipment, and workspace

When hiring in Kazakhstan, it’s not just about contracts and salaries. How you manage payroll, benefits, equipment, and workspace can make the difference between a compliant, productive team and endless headaches for HR and finance.

Here’s how Employer of Record (EOR) and PEO models handle the operational side of things.

Payroll compliance and tax management

With an EOR in Kazakhstan, payroll compliance is fully managed. That means:

Salaries are calculated accurately, including deductions for income tax (progressive, up to ~35%) and social security contributions (~20–22%).

All payroll filings are submitted to the Revenue Administration and social security offices on time.

Finance teams receive a single, predictable invoice covering salaries, taxes, and social contributions, reducing administrative burden and minimizing risk.

A PEO can process payroll as well, but the legal responsibility remains with your company. Any errors in tax withholding or filing fall on your entity, making the EOR model safer for companies without a local presence.

Employee benefits

EOR-provided benefits in Kazakhstan cover all statutory requirements:

Paid annual leave (14–20 days depending on tenure)

Sick leave and maternity leave

Social insurance contributions

Optional perks, like health insurance or allowances, can also be administered through the EOR.

PEO benefits, on the other hand, are generally limited to administration. Your company remains responsible for ensuring statutory compliance, increasing the risk of missteps.

For a deeper dive into benefits, insurance, and workspace support in Kazakhstan, see our Employee Benefits, Insurance, & Workspace guide (EOR-07).

Equipment policies

EORs can manage equipment provisioning for employees, including laptops, monitors, and other tools, ensuring your team is ready to work from day one—even if your company has no local office.

With a PEO, equipment provisioning is usually advisory. Your company must provide and manage hardware, which can create operational friction, especially for remote-first teams.

Workspace options and remote work

Employees hired through an EOR in Kazakhstan can work remotely, from home, or from coworking spaces, depending on your business needs. The EOR ensures compliance with local workplace regulations and can guide setup for hybrid or distributed teams.

PEO arrangements typically assume employees are tied to a local entity, which can limit flexibility for remote or distributed work.

Summary table: Operational differences

Operational Area | EOR Kazakhstan | PEO Kazakhstan |

Payroll Compliance | Fully handled by EOR; taxes & filings included | Admin support; liability stays with company |

Benefits | Statutory + optional benefits managed | Admin support only; company liable for compliance |

Equipment | Provided/administered by EOR | Company provides; PEO may advise |

Workspace & Remote | Flexible remote and hybrid options | Tied to local entity policies; less flexibility |

An EOR doesn’t just cover legal compliance in Kazakhstan; it simplifies operations for HR, finance, and IT, giving your employees the tools, workspace, and benefits they need to be productive from day one.

Hiring flexibility: Employees vs contractors via Employer of Record and PEO in Kazakhstan

When expanding into Kazakhstan, one of the first questions companies ask is: “Can I hire contractors instead of full-time employees?” The answer isn’t just about preference, it’s about legal compliance, risk management, and operational flexibility.

Can an EOR hire contractors in Kazakhstan?

Yes, an Employer of Record (EOR) can engage independent contractors, but there are important nuances.

While EORs are primarily designed for full-time employees, they can legally manage contractor arrangements as long as the contract clearly defines scope, deliverables, and payment terms. This ensures compliance with Kazakh labor and tax laws and prevents misclassification.

Direct contractor hiring, on the other hand, leaves your company fully exposed.

Misclassifying a full-time-like contractor can trigger fines, backpay, and compliance audits. Using an EOR mitigates these risks, giving you the flexibility to hire legally without setting up a local entity.

Professional employer organization and contractor flexibility

PEOs in Kazakhstan operate under a co-employment model and assume administrative responsibilities, but the legal employer remains your company. This limits flexibility for contractors:

Contractors may be treated as employees under local law if they work full-time hours, use company tools, or report directly to your team.

Compliance responsibility, including payroll taxes and social contributions, remains with your company.

In practice, a PEO is better suited for supporting employees under an existing local entity rather than managing contractors or flexible project-based hires.

Compliance considerations

Whether you engage contractors through an EOR or a PEO, you need to consider:

Classification rules: Ensure contractors meet legal definitions to avoid being treated as employees.

Payroll & tax reporting: Even contractors may have tax obligations; an EOR ensures proper withholding and filings.

Benefits & entitlements: Contractors are not entitled to statutory benefits, but any optional perks or equipment provided must be properly documented.

Key takeaways

Hiring Type | EOR Kazakhstan | PEO Kazakhstan |

Full-time employees | Fully managed: payroll, benefits, compliance | Admin support only; liability remains with your company |

Independent contractors | Can engage; EOR ensures compliance | Limited; misclassification risk remains with company |

Flexibility | High – legally compliant contractor or employee engagement | Moderate – primarily employees; contractors may face legal risk |

Engaging contractors via an EOR in Kazakhstan provides the flexibility to scale your team for projects or pilot initiatives without taking on compliance risk. In contrast, direct contractor hiring or relying on a PEO exposes your company to potential audits or fines.

Conclusion: Choosing between PEO and Employer of Record for your Kazakhstan hiring needs

Expanding into Kazakhstan is exciting, but it comes with a clear reality: how you hire matters as much as who you hire. Choosing between a PEO and an Employer of Record (EOR) depends on a few key factors:

Company size and expansion stage: Small pilot teams or first hires in Kazakhstan are best served by an EOR, which lets you hire quickly without a local entity. Larger companies with an established local entity might consider a PEO for administrative support while keeping legal responsibility in-house.

Compliance needs: If you want full legal coverage, payroll, taxes, social contributions, and statutory benefits, an EOR removes risk. PEOs provide guidance and admin, but liability remains with your entity.

Cost considerations: EORs offer predictable, all-inclusive fees per employee, simplifying budgeting. PEOs may seem cheaper upfront but can carry hidden costs and compliance risk.

Access to talent: EORs allow you to tap into Kazakhstan’s growing labor market immediately, including full-time employees and compliant contractors, without entity setup.

Actionable next step: Evaluate the top EOR providers in Kazakhstan to find a partner that aligns with your hiring goals and operational needs. Using an EOR allows you to hire fast, stay compliant, and scale efficiently.

Frequently asked questions

What does PEO stand for?

PEO stands for Professional Employer Organization, a company that manages HR, payroll, benefits, and compliance for your employees under a shared employment model.

What is a PEO, and how does it work?

A PEO handles administrative HR tasks for your business. You still manage your team day-to-day, while the PEO takes care of payroll, benefits, and labor compliance. It’s ideal for small and mid-sized businesses

What’s the difference between PEO and EOR?

A PEO co-employs your staff, while an EOR (Employer of Record) becomes the legal employer for your remote or international team. PEOs require you to have a local entity; EORs don’t.

PEO vs Employer of Record, which one is better?

If you already have a legal entity, a PEO helps manage payroll and compliance. If you don’t, an EOR hires employees on your behalf. Many companies start with an EOR, then switch to a PEO once they establish a local entity.

What does EOR stand for?

EOR stands for Employer of Record — a company that legally employs workers on behalf of another business, handling payroll, compliance, and contracts while you manage day-to-day work.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) allows you to hire full-time employees in other countries without setting up a local entity. The EOR manages payroll, taxes, and compliance — you manage performance.

What does EOR mean in HR?

In HR, EOR means outsourcing employment responsibilities to a third-party provider. This helps companies onboard and pay global employees legally while maintaining control of daily operations.

How does an Employer of Record work?

The EOR signs a local employment contract with your employee, processes payroll, withholds taxes, and manages benefits — while you manage daily tasks and performance.