Employer of Record (EOR) vs setting up your own entity in Turkey: Which is better?

- Jul 24, 2025

- 7 min read

Table of contents:

Introduction

You want to hire in Turkey. The market is hot, the talent pool is real, and your competitors are already sniffing around.

But here’s the thing: Do you really want to go all in, lawyers, accountants, tax registrations, the works, before even hiring your first employee?

Or do you want a faster way in?

That’s the question.

Because there are two ways to do this:

Set up your own legal entity (hello paperwork).

Or partner with an Employer of Record (EOR) and start hiring in weeks.

Each has its perks. Each has its pain.

This article won’t push you either way just yet. It’s here to help you get clear. Control vs. speed. Simplicity vs. independence.

Ready to figure out which one actually fits your goals?

Let’s get into it.

What is an EOR in Turkey?

If you’ve ever wished you could hire talent in Turkey without setting up a company there, congrats, you’re thinking like an EOR client.

An Employer of Record (EOR) in Turkey is a legal entity that hires employees on your behalf. You get the team. They handle the paperwork. That means contracts, payroll, taxes, benefits, and compliance, all done locally, without you needing to open a Turkish entity.

How it works:

You find the person you want to hire (or get help finding them). Your EOR provider in Turkey (like us) signs the employment contract, registers them with local authorities, runs payroll, and ensures legal compliance. The employee works for you, just not technically on your books.

Why do companies choose an EOR in Turkey?

Because it’s fast, you can onboard in days, not months.

Because it’s simple. No local lawyers, accountants, or government paperwork.

And because it’s safe. You avoid legal risks that come with hiring contractors or misclassifying employees.

This is especially valuable in Turkey, where employment law is formal, tax rules are unforgiving, and surprise inspections are very much a thing.

So, if you’re trying to build a remote team without building a legal structure, this is how you do it.

Setting up your own entity in Turkey

So, you want full control. Your name on the license. Your logo on the payroll. That means setting up your own entity in Turkey.

Here’s what that actually looks like.

Step-by-step setup

Choose a legal structure

Subsidiary: Separate legal entity, your company owns it but it operates independently.

Branch office: Same legal identity as the parent company. Easier setup, but more risk.

Representative office: You can’t hire or invoice, but great for R&D, scouting, or sales ops.

Joint venture: You team up with a local business. Split the risk, and the rewards.

Local corporation: Full local entity. High control. Higher legal maintenance.

Register with Turkish authorities

You’ll need a local tax ID, trade registry number, and registration with the Social Security Institution (SGK). This process takes weeks, not days. Think paperwork, not plug-and-play.

Set up local payroll and HR compliance

Turkish labor law is formal. Every contract, every benefits policy, every payslip must follow the rules, especially if you plan to hire more than five people.

What it really costs

Setting up your own entity isn’t just about the fees. It’s about the effort:

Legal fees – Incorporation, translations, licensing, notarizations.

Compliance – Monthly filings, mandatory audits, local representation.

Payroll infrastructure – Hiring HR managers, accountants, or both.

Time – Expect 6–10 weeks before you’re legally allowed to onboard someone.

Cost comparison: EOR vs entity in Turkey

Let’s talk money. Because while everyone loves talking strategy and scalability, you still have a budget to stick to.

Here’s how the numbers look when comparing an Employer of Record (EOR) with setting up your own entity in Turkey.

Monthly cost breakdown (EUR)

EOR (Team Up) | Own Entity | |

Setup Fees | €0 | €4,000–€7,000 (lawyers, notary, admin) |

Monthly Admin (1 employee) | €299 | ~€250–€400 (HR, payroll, tax filing) |

Payroll Taxes | Included | 22.5%–25% of gross salary |

Compliance & Reporting | Included | You manage or outsource |

Entity Maintenance | €0 | Ongoing fees (tax, audit, local rep) |

Example comparison: 1 / 5 / 10 employees

(Assuming €2,000 net monthly salary per employee)

EOR (Team Up, €299 per employee)

Team Size | Base Salary | EOR Fee | Total Monthly |

1 | €2,000 | €299 | €2,299 |

5 | €10,000 | €1,495 | €11,495 |

10 | €20,000 | €2,990 | €22,990 |

No hidden extras. No local registrations. No paperwork on your desk.

Own Entity

Team Size | Base Salary | Employer Tax (avg 24%) | Admin + Compliance | Total Monthly |

1 | €2,000 | €480 | €300+ | €2,780+ |

5 | €10,000 | €2,400 | €500+ | €12,900+ |

10 | €20,000 | €4,800 | €750+ | €25,550+ |

Add to that:

~€5,000 entity setup cost

Local rep, tax filings, end-of-year audits

Delayed launch (4–6+ weeks)

So, what are you really paying for?

With EOR, you get a compliance checklist, payroll, and admin wrapped into one monthly fee. You hire in days.

With your own entity: You get control, but you pay in time, cost, and complexity.

Want to see exactly what your setup would cost?

Talent acquisition & payroll

Remote hiring in Turkey is not the hard part.

Hiring compliantly in Turkey, and actually paying people the right way, is where companies burn time, money, and legal peace of mind.

Let’s make this easy to compare.

The kind of talent you're competing for in Turkey

Turkey isn’t just about cheap labor; it’s about qualified people who stay. Here’s what’s actually in the market:

Senior backend engineers fluent in Java, .NET, Node.js

German-speaking support reps based in Istanbul and Izmir

B2B SDRs and account managers with EU sales experience

Experienced QA testers and automation engineers

Product managers used to working async with Western teams

These aren’t juniors begging for work. They have options. Which means: If you’re not hiring through a legal structure they trust, you’re out.

What an EOR changes

An EOR isn’t just outsourcing payroll. It’s a full legal employment solution.

Team Up hires your candidate on your behalf on paper; they’re our employee. But day-to-day, they work 100% for you.

We handle:

Localized employment contracts (Turkish and English if needed)

Registration with SGK, GİB, İŞKUR, etc.

Payroll taxes, health insurance, and severance accruals

Payslips, local banking, and end-of-year filings

The employee gets paid on time, gets covered benefits, and sees you as their employer. You get to grow a team in Turkey without learning Turkish tax code at midnight.

Payroll processing under employer of record services in Turkey

Here’s what the cost is to use EOR in Turkey:

€299/month per employee

You pay gross salary + our fee

We handle the rest, reporting, payment, insurance, and filings

No admin. No fines. No random state letters you can’t read.

Now compare that to doing it yourself:

Set up a local entity

Hire an accountant or an in-house HR/payroll professional

Register with multiple agencies

Run monthly calculations & filings

Keep up with changing labor laws

You’ll spend weeks just learning what not to do.

Compliance & legal risks

Let’s be real. Turkish labor law is not a playground.

The fines aren’t cute. The paperwork isn’t in English. And the rules change, often.

If you’re hiring in Turkey without either (1) your own legal entity or (2) an EOR backing you…

Then you’re betting your whole operation on “Eh, we’ll figure it out later.”

That doesn’t end well.

Here’s what’s at stake

Misclassification

If you treat a contractor like an employee, with fixed hours, exclusive work, and paid leave, the Turkish state will reclassify them. Retroactively. With penalties.

Missing social contributions

You owe monthly payments to SGK (social security), İŞKUR (employment agency), and tax authorities. Miss one, and you’re in violation, even if the salary was paid on time.

Wrong contracts

Local law requires Turkish-language employment contracts with clauses that reflect actual working conditions. Cookie-cutter foreign templates don’t count.

Legal risks of hiring in Turkey without an employer of record

Unregistered employment = heavy fines

Workers can sue for benefits & compensation

You risk backdated tax and insurance contributions

It can delay or block your ability to open an entity later

Reputational damage with future hires (especially in tech)

What an EOR shields you from

When you hire through Team Up, we’re on the hook for compliance. Not you.

That means:

Local contracts, updated for the Turkish labor code

Employee registration with the right authorities

Timely payroll taxes, SGK contributions, and filings

Legal coverage if an audit or dispute arises

Your employee gets legal protection. You get peace of mind.

Nobody ends up calling a Turkish lawyer at 2 am, wondering what “brüt maaş” means.

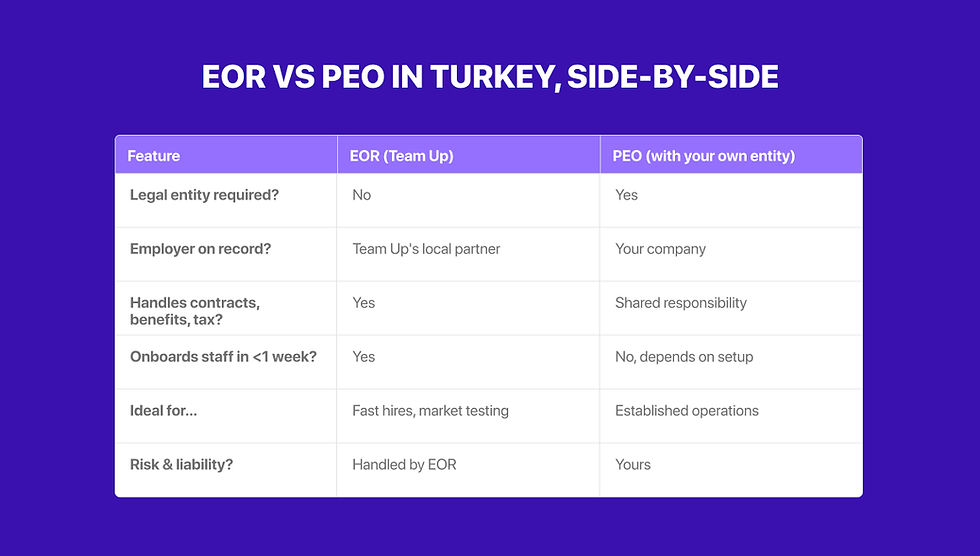

EOR vs PEO in Turkey

Let’s kill the confusion:

An EOR (Employer of Record) and a PEO (Professional Employer Organization) are not the same thing.

The big difference?

EOR = you don’t need a legal entity

PEO = you do

If you're just entering Turkey and don’t want to deal with registrations, audits, and government paperwork, EOR is your shortcut.

If you already have an entity in Turkey and just want HR and payroll support, PEO might work.

EOR vs PEO in Turkey, side-by-side

Feature | EOR (Team Up) | PEO (with your own entity) |

Legal entity required? | No | Yes |

Employer on record? | Team Up's local partner | Your company |

Handles contracts, benefits, tax? | Yes | Shared responsibility |

Onboards staff in <1 week? | Yes | No, depends on setup |

Ideal for… | Fast hires, market testing | Established operations |

Risk & liability? | Handled by EOR | Yours |

Making the right call

Let’s not pretend this is a philosophical debate.

It’s a business decision.

Here’s how to think about it:

If you need speed, flexibility, and zero paperwork?

Go with an Employer of Record in Turkey. You’ll be live in days, not months. No registration, no legal mess, no hiring delays.

If you plan to scale big, stay long, and want full control?

Setting up your own entity may be worth the hassle. You’ll own the structure, the payroll, the compliance, and the risk.

Some teams start with an EOR and switch to their own entity later.

That’s not flip-flopping — it’s smart scaling.

The point?

There’s no one-size-fits-all playbook.

But there is one partner who can help you map it all out without wasting six months and €10K on avoidable mistakes.

And yeah, that would be us.

Conclusion

You’re not choosing between “good” and “bad” here.

You’re choosing between fast and lean or full control with a side of bureaucracy.

Here’s what’s on the table:

EOR = speed, compliance, and zero red tape

Entity = ownership, long-term cost-efficiency, and more complexity

Both paths can work. But only one fits where your business is right now.

You’ve got the map.

Now choose your route.

Need help picking the right one?

Talk to Team Up, we help you hire in Turkey without the guesswork.