Employer of Record (EOR) vs payroll outsourcing in India: What’s the difference?

- Sep 17, 2025

- 7 min read

Table of contents:

Introduction

Plenty of companies throw around “payroll outsourcing” and “Employer of Record (EOR)” as if they’re the same thing.

They aren’t.

And in India, mixing them up can cost you, literally.

One path keeps you compliant, gets your team working fast, and gives employees the benefits they expect.

The other? It might leave you with a tax inspector at the door, fines piling up, and a workforce wondering why their PF contributions never showed up.

g

That’s the problem: if you pick the wrong model, you’re either overpaying for services you don’t need or carrying compliance risks you didn’t realize you had.

And once Indian authorities get involved, ignorance isn’t a defense.

In this guide, we’ll break down the real difference between payroll outsourcing and an EOR in India. You’ll learn:

What payroll outsourcing actually covers (and what it doesn’t).

How an EOR goes beyond payslips to handle contracts, benefits, compliance, and visas.

Cost differences and when each option makes sense.

The risks of getting it wrong, and why many global companies are moving toward EOR.

Let’s get started.

What is payroll outsourcing in India?

Payroll outsourcing in India is exactly what it sounds like: you hand over the mechanics of running payroll to a third-party vendor.

In India, this typically means:

Calculating gross and net salaries.

Deducting income tax at source (TDS).

Managing employer and employee contributions to the Provident Fund (PF) and Employee State Insurance (ESI).

Generating payslips and payroll reports.

Submitting monthly and annual payroll-related filings to government authorities.

By handing these tasks to payroll outsourcing companies, businesses can avoid the manual, error-prone burden of running payroll in-house.

What payroll outsourcing covers, and what it doesn’t

It’s important to recognize that payroll outsourcing is limited in scope. While it does handle salary disbursements and filings, it does not:

Draft or issue compliant employment contracts.

Provide employee benefits like gratuity, maternity leave, or insurance.

Manage onboarding or termination processes.

Handle state-specific labor laws under the Shops & Establishments Acts.

In short, payroll outsourcing keeps employees paid and statutory deductions filed, but it won’t protect you if a labor inspector comes knocking.

Who typically uses payroll outsourcing services in India?

Payroll outsourcing is best suited for companies that already have a legal entity registered in India but lack the in-house expertise to manage payroll. Typical users include:

Multinationals with a small subsidiary office in India.

Mid-sized companies expanding regionally but without a local HR/payroll team.

Businesses that want to focus on operations while outsourcing administrative functions.

Payroll outsourcing costs in India

Fees are generally charged on a per-employee, per-month basis, with rates depending on:

Number of employees.

Complexity of payroll (multiple allowances, bonuses, etc.).

Additional services (onboarding, offboarding, compliance reports).

On average, payroll outsourcing cost in India ranges between ₹200–₹500 per employee per month, with additional charges for specialized services. While affordable, it is still only a partial solution; it simplifies payroll, but legal and compliance liability stays with the employer.

What is an Employer of Record (EOR) in India?

An Employer of Record (EOR) in India is a third-party organization that becomes the legal employer of your staff on paper, while you control their day-to-day work.

Unlike payroll outsourcing, which only runs salary calculations, an EOR covers the entire employment lifecycle. That means:

Drafting compliant contracts under Indian labor law.

Running payroll in INR with correct TDS, PF, and ESI filings.

Administering statutory benefits like gratuity, maternity leave, and annual bonuses.

Managing onboarding, leave tracking, and termination settlements.

Issuing exit documentation, like relieving letters and experience certificates.

Why it matters

By acting as the official employer, the EOR absorbs compliance risk. You don’t need to worry about state-specific Shops & Establishments rules, inspections, or fines; your EOR provider in India ensures filings are accurate and on time. This makes EORs especially attractive for foreign companies that don’t have in-house expertise on India’s labor regulations.

How EOR works in India

Here’s the real game-changer: with an EOR, you don’t need to set up a subsidiary or register under multiple state labor laws. You can hire employees in India without opening a local entity. The EOR’s existing infrastructure allows you to onboard talent in weeks, not months. For global businesses, this means:

Faster entry into the Indian market.

No upfront incorporation or registration costs.

Flexibility to test the market before committing long-term.

The EOR advantage

Where payroll outsourcing stops at payslips, an EOR provides full HR administration, ensuring compliance, employee satisfaction, and smoother operations from day one.

Key differences: EOR vs payroll outsourcing in India

Payroll outsourcing is narrow; it covers salary calculations, tax withholdings, and PF/ESI filings. That’s it. An Employer of Record (EOR), on the other hand, takes on the entire employment lifecycle.

Contracts, onboarding, benefits, leave, terminations, and even immigration support are all bundled into one solution.

Entity requirement

Payroll outsourcing assumes you already have a registered entity in India. Without one, you can’t legally employ staff, even if a vendor runs your payroll. An EOR removes that barrier completely. You can hire in India without setting up a local entity, leveraging the EOR’s existing registrations.

Compliance coverage

Here’s where the difference becomes critical. Payroll outsourcing won’t protect you if an inspector asks for Shops & Establishments records, or if an employee disputes maternity leave. With EOR, you’re covered. They ensure:

Statutory benefits (PF, ESI, gratuity, maternity leave).

Contracts compliant with Indian law.

Visa sponsorship for expat employees.

Exit compliance with relieving letters and settlements.

Risk allocation

With payroll outsourcing, you remain liable for mistakes. If contributions are missed or state filings are late, your company takes the hit. With an EOR, the liability shifts to the provider. They are the legal employer on paper, so they carry the compliance responsibility.

Cost comparison: Payroll outsourcing vs EOR in India

Cost differences and when each option makes sense:

How payroll outsourcing is priced

Most payroll outsourcing companies in India charge on a per-employee, per-month basis. The average ranges from ₹200–₹500 per employee per month, depending on complexity. On top of that, vendors may add extra charges for:

Payroll runs (every month).

Onboarding and exit processing.

Compliance reporting or year-end filings.

It looks cheap on paper, but remember, payroll outsourcing assumes you already have an Indian entity. The real costs of incorporation, HR staff, office space, and ongoing compliance sit outside the outsourcing fee.

How EOR pricing works

An Employer of Record (EOR) bundles everything into one predictable monthly cost. At TeamUp, that’s a flat €199 per employee, per month. Other providers may use a percentage-of-salary model (10–15%), which gets expensive for senior hires.

With EOR pricing, you’re not just paying for payslips, you’re covering:

Contracts and onboarding.

Payroll, PF, ESI, and TDS filings.

Statutory benefits (gratuity, maternity leave, bonuses).

Offboarding and compliance documentation.

Real-world cost impact: 5 employees in Bengaluru

Imagine hiring five engineers in Bengaluru at ₹100,000/month each (~€1,100).

Payroll Outsourcing:

Vendor fees: ~₹500 × 5 employees × 12 months = ~₹30,000/year (~€330).

But add entity setup (€15,000+), HR staff, audits, and legal retainers.

Total Year 1 overhead: €30,000–€40,000+, excluding salaries.

EOR (TeamUp):

Flat fee: €199 × 5 × 12 = €11,940/year.

Zero incorporation or audit costs.

For small to mid-sized teams, the savings are obvious. With EOR, you spend less and start faster. Payroll outsourcing only makes sense once you already have a large, established entity.

Use cases: When to choose payroll outsourcing vs EOR

Payroll outsourcing works if your company already has a registered entity in India. You’ve handled incorporation, Shops & Establishments registration, GST, PAN, and TAN.

All you need now is someone to run payslips, calculate deductions, and file PF/ESI contributions. Outsourcing payroll is a cost-efficient way to reduce HR admin, but compliance responsibility still sits with you.

Best fit:

Multinationals with established Indian subsidiaries.

Companies with 50+ employees needing efficient payroll runs.

Businesses with strong in-house HR/legal teams that can handle contracts and compliance.

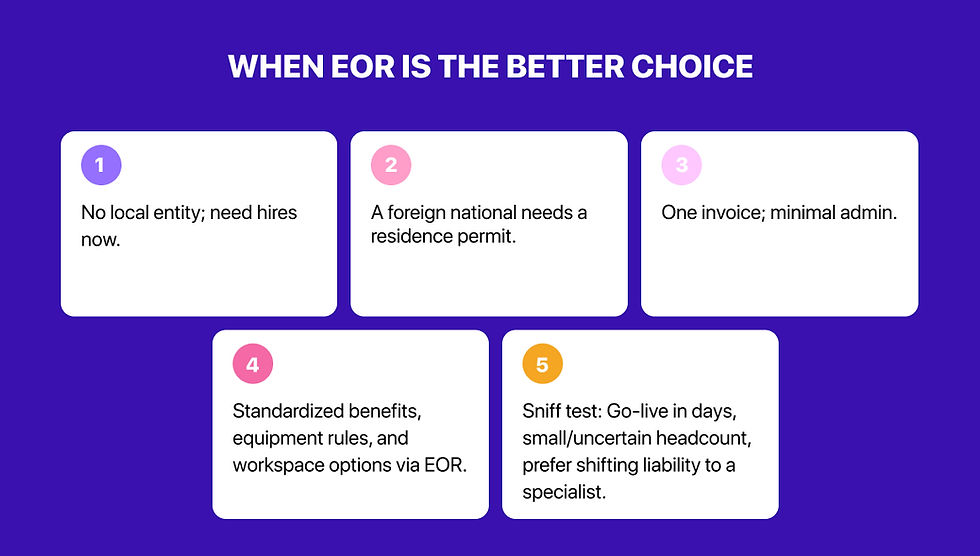

When EOR is the better choice

An Employer of Record (EOR) is ideal when you don’t want the burden of entity setup but still need to hire full-time employees in India. With an EOR, you can start legally employing staff in weeks, not months.

The EOR manages everything: contracts, payroll, benefits, compliance filings, and offboarding. This option reduces risk and speeds up entry.

Best fit:

Startups are testing the Indian market before making big investments.

Remote-first companies that want to hire individuals across multiple Indian states without separate registrations.

Enterprises are scaling quickly and need compliance certainty.

The hybrid path

Many global companies start with an EOR to test the market, build a pilot team, or ramp up quickly. Once they reach scale, say 50+ employees, they transition to setting up a local entity. At that point, payroll outsourcing becomes the cheaper long-term option.

Best fit:

Growth-stage companies that see India as a long-term hub.

Businesses that want to balance speed now with control later.

Risks of choosing the wrong model

The risks of getting it wrong, and why many global companies are moving toward EOR:

Misclassifying Employees

Here’s the blunt truth: if you try to run payroll outsourcing without a registered entity in India, you’re not just cutting corners, you’re breaking the law. Employees hired under the wrong setup can be considered misclassified, which opens the door to disputes, lawsuits, and back payments. In India, labor courts rarely side with the employer in these cases.

Missing Statutory Filings

Payroll outsourcing vendors may process payslips, but compliance is still your liability. If PF, ESI, or tax filings are delayed or incorrect, the Indian authorities won’t fine the vendor—they’ll fine your company. Penalties pile up quickly, and repeat non-compliance can even block future registrations.

Poor Employee Experience

In India, employees expect more than a payslip. They look for Provident Fund contributions, health insurance, gratuity provisions, and clear leave policies. Payroll outsourcing doesn’t deliver these; it only covers salary processing. The result? Employees feel shortchanged, attrition rises, and your brand reputation takes a hit.

Choosing an Employer of Record (EOR) avoids these traps. EORs act as the legal employer, absorb compliance risk, and deliver the full statutory benefits employees expect.

Conclusion

EOR and payroll outsourcing aren’t interchangeable. Payroll outsourcing is useful when you already have an Indian entity and just need someone to run payslips and filings.

But if you want to hire in India without setting up a local company, stay compliant across multiple states, and give employees the benefits they expect, an Employer of Record (EOR) is the clear choice.

At TeamUp, we keep it simple. For a flat €199 per employee, per month, you get everything payroll outsourcing can’t give you, legal contracts, statutory benefits, full compliance, and an employee experience that builds loyalty from day one.