Employer of Record (EOR) vs payroll outsourcing in Eastern Europe: What’s the difference?

- Aug 28, 2025

- 7 min read

Updated: Dec 23, 2025

Table of contents:

How does the legal responsibility differ between EOR and payroll outsourcing?

Key legal risks if you choose payroll outsourcing instead of EOR

How do costs compare when choosing EOR versus payroll outsourcing for Eastern European companies?

How quickly can you establish or switch between EOR and payroll?

Quick definitions you can act on

What’s the real difference between hiring through an EOR and just outsourcing payroll in Eastern Europe, and which one actually protects your business?

You’re not the only one asking. A lot of companies expanding into Poland, Romania, or Bulgaria hit this exact fork in the road, especially when the pressure’s on to hire fast, stay compliant, and avoid getting lit up in an audit.

Here’s your cheat sheet:

Employer of Record (EOR) in Eastern Europe:

An EOR becomes the legal employer of your team in-country. They take on the full stack:

Employment contracts

Payroll and tax filings

HR documentation and compliance

Statutory benefits and contributions

Terminations and labor disputes

You still manage the day-to-day work. But legally? They carry the burden.

Payroll Outsourcing:

Payroll providers in Eastern Europe only handle numbers. That’s it.

You’re still the legal employer. You need a local entity. And you’re on the hook for:

Employment contracts

Disciplinary processes

Benefits compliance

Labor inspections and audits

Put simply: payroll outsourcing = administrative help. EOR = liability shield.

Curious about when each model pays off?

Keep reading, we’ll unpack break-even costs, legal risks, and how fast you can get started.

How does the legal responsibility differ between EOR and payroll outsourcing?

Here’s where most businesses trip over the fine print.

When you hire through an Employer of Record (EOR) in Eastern Europe, they are the legal employer on paper. That means:

They sign the contract

They’re liable for terminations

They handle employment law compliance

They deal with labor inspectors (not you)

You still lead the work. But the employment risk? Not yours.

Now compare that to payroll outsourcing.

You might have a provider calculating salaries and filing taxes, but you are still:

Issuing contracts under your local entity

Navigating terminations and disputes

Exposed in an audit or court case

Translation: payroll outsourcing moves tasks, not liability. If something goes sideways, you’re in the hot seat.

What about PEOs?

Professional Employer Organizations (PEOs) offer a co-employment model, where both parties “share” employer responsibilities.

Sounds neat, until you realize this structure isn’t legally recognized in many Eastern European countries. So if you're relying on a U.S.-style PEO setup here, good luck explaining that to the Romanian labor authorities.

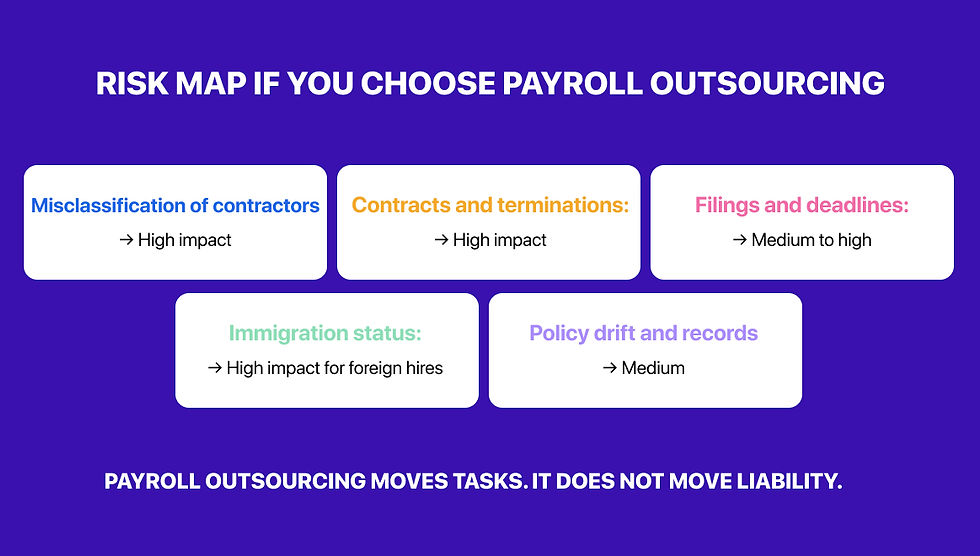

Key legal risks if you choose payroll outsourcing instead of EOR

Payroll outsourcing might seem like the “safe” middle ground, until it’s your signature on the contract and your company name on the audit report.

Here’s what catches most teams off guard:

1. Misclassification risk

If you’ve been hiring “contractors” in Eastern Europe just to keep things lean, you're already walking a tightrope. This contractor-first approach is common with outsourced payroll setups, but regulators are catching up fast.

One bad classification and suddenly you’re dealing with forced reclassification, backdated benefits, and tax liabilities that could stretch back years.

2. Your payroll provider isn’t your legal shield

Outsourcing payroll doesn’t mean outsourcing risk. Your provider might file taxes and issue payslips, but when it comes to:

Termination disputes

Missing benefits

Labor law violations

You’re still the employer of record. That means you’re still the one in court.

3. Audit exposure and back taxes

Eastern Europe isn’t shy about audits. In markets like Bulgaria and Poland, authorities are tightening the screws on foreign employers.

If you get flagged and your contracts or filings don’t line up with local labor law? Be ready for hefty fines, late payment interest, and maybe even operational suspension.

Don’t say we didn’t warn you.

How do costs compare when choosing EOR versus payroll outsourcing for Eastern European companies?

Let’s talk numbers, because cost always finds its way into the conversation.

EOR pricing: all-in, per-employee simplicity

Hiring through an Employer of Record (EOR) in Eastern Europe means paying a flat monthly fee per employee, typically between €199–€399 depending on country and benefits scope.

But that number covers a lot:

Legal employment contracts

Payroll calculation and tax filing

Statutory benefits (health, pension, etc.)

HR compliance and labor law updates

Offboarding, terminations, audits—everything

No surprises. No hidden costs. Just one invoice per month.

Payroll outsourcing: lower fee, higher internal lift

On paper, payroll outsourcing looks cheaper. The monthly provider fee is lower. But:

You still need to set up a local entity

You need internal HR/legal resources

You carry the compliance risk

You’ll pay separately for:

Entity registration

Ongoing legal and accounting help

Local HR admin or consultants

So while the provider’s fee may look lean, your total cost of ownership creeps up fast.

Break-even insight: when each model wins

1–3 hires: EOR is usually faster, cleaner, and more cost-effective

5+ hires, stable team: Payroll + entity may be worth the overhead

But that assumes you’re okay owning local legal risk.

How quickly can you establish or switch between EOR and payroll?

When it comes to entering a new market, timing isn’t a detail, it’s the whole game. Let’s break down how fast you can get started (or switch) in Eastern Europe, depending on the model you choose.

EOR onboarding: up and running in days

If you’re using an Employer of Record, you can hire in as little as 2–5 business days.

No entity. No registrations. No banking delays.

The EOR already has infrastructure in place, they just add your employee, issue the contract, and handle the onboarding.

Perfect for urgent hires or compliance-safe test runs.

Entity + payroll outsourcing: 4–6+ weeks minimum

Going the payroll route? You’ll first need to:

Register a local entity

Open local bank accounts

Sign up for tax and social security

Set up HR and legal documentation

Best-case scenario: you’re ready in a month. Worst-case? Delays at every step, especially in Romania or Bulgaria, where bureaucracy isn’t exactly known for speed.

Switching scenarios: what it really looks like

Payroll → EOR: You’ll need to formally terminate the employee from your local entity and rehire them under the EOR. It’s clean and fast, but needs coordination to preserve role and benefits continuity.

EOR → Payroll: After you’ve set up your own entity, the employee’s contract can be novated (transferred) to your business. You then assume all employer obligations moving forward.

If you’re expanding into multiple countries or are not sure where headcount will grow, switching models is common and manageable.

What scenarios make EOR the better choice?

EOR isn’t always the cheapest option on paper, but when you zoom out and look at the time, risk, and admin load it saves, it often ends up being the smarter move, especially in Eastern Europe, where compliance rules differ from Poland to Bulgaria to Romania.

Here’s when it’s the obvious choice:

You don’t have a local entity

No entity means no payroll. If you don’t want to burn months on company registration, banking, and tax filings, EOR gets you hiring in days instead of weeks. You skip the paperwork and still stay compliant.

You’re hiring foreign workers who need permits

Immigration law in Eastern Europe is anything but “plug-and-play.” Work and residence permits differ by country, and the penalties for getting it wrong are steep. An EOR can sponsor employment, manage filings, and ensure your hire is legally covered—so you’re not scrambling at the border.

You want one invoice and zero admin burden

With EOR, everything’s bundled:

Contracts

Payroll

Tax submissions

Social contributions

Benefits administration

It all rolls up into one monthly invoice. No juggling lawyers, accountants, and payroll vendors in three different languages.

When payroll outsourcing is enough

Payroll outsourcing is the right call only once you’ve built the foundation to support it. If your company already has a legal footprint in Eastern Europe and you’re comfortable handling compliance in-house, payroll outsourcing can streamline the admin without overcomplicating things.

You already have a registered entity

Payroll providers can’t operate without one. If your entity is set up, your bank accounts are active, and you’ve registered with local tax and social security authorities, then outsourcing payroll makes sense. The provider handles calculations and filings—you remain the employer.

You’re comfortable managing HR and compliance

Payroll outsourcing won’t write contracts, update policies, or sit across from a labor inspector. That’s still on you. If your HR and legal teams can confidently manage contracts, disputes, and audits, then outsourcing payroll frees up time without removing responsibility.

Your team is stable and growing

For 5+ long-term employees, the math often tilts in favor of payroll over EOR. Once the setup costs of your entity are spread across a stable headcount, per-employee outsourcing fees are lower, and you maintain complete control.

In short, if you’ve got the infrastructure and the confidence to own employer liability, payroll outsourcing is enough. If you don’t? Stick with EOR until you’re ready.

Comparison table

If you’re still weighing your options, here’s a side-by-side look at the four main hiring models used in Eastern Europe: EOR, payroll outsourcing, PEO, and setting up your own entity.

Feature | EOR | Payroll Outsourcing | PEO | Own Entity |

Legal employer | EOR | You | You | You |

Entity required | No | Yes | Yes | Yes |

Time to start | Days | 4–6+ weeks | 4–6+ weeks | 6–8+ weeks |

Compliance owner | EOR (contracts, benefits, taxes, audits) | You | You (shared admin, no liability transfer) | You |

Immigration support | Yes, included | No | Varies by provider | You manage directly |

Cost model | Per employee per month | Setup fees + monthly processing + internal HR/legal | Admin + co-employment fees | High setup + ongoing operations |

Risk exposure | Low—EOR carries liability | High—risk stays with you | High—liability remains with you | High—you own everything |

Pro tip: Don’t just look at the monthly invoice. Factor in legal liability, time to start, and how much back-office admin you’re willing to run.

Conclusion

Choosing between EOR and payroll outsourcing in Eastern Europe isn’t about which one is “better” overall, it’s about which one fits where you are right now.

If you need fast entry, minimal admin, and a compliance safety net, EOR is the smarter route. It gets people legally hired in days, without the overhead of setting up an entity or building a local HR team.

If you’ve already put in the work, registered an entity, built HR and legal processes, and plan to scale a stable, permanent team, then payroll outsourcing can be the more efficient play. You keep control, while the provider takes the repetitive admin off your plate.

Need clarity on your expansion plan?

Get a personalized Eastern Europe hiring strategy in 24 hours with cost comparisons, risk analysis, and timelines mapped to your headcount goals.